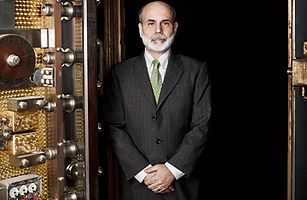

A bald man with a gray beard and tired eyes is sitting in his oversize Washington office, talking about the economy. He doesn't have a commanding presence. He isn't a mesmerizing speaker. He has none of the look-at-me swagger or listen-to-me charisma so common among men with oversize Washington offices. His arguments aren't partisan or ideological; they're methodical, grounded in data and the latest academic literature. When he doesn't know something, he doesn't bluster or bluff. He's professorial, which makes sense, because he spent most of his career as a professor.

He is not, in other words, a typical Beltway power broker. He's shy. He doesn't do the D.C. dinner-party circuit; he prefers to eat at home with his wife, who still makes him do the dishes and take out the trash. Then they do crosswords or read. Because Ben Bernanke is a nerd.

He just happens to be the most powerful nerd on the planet.

Bernanke is the 56-year-old chairman of the Federal Reserve, the central bank of the U.S., the most important and least understood force shaping the American — and global — economy. Those green bills featuring dead Presidents are labeled "Federal Reserve Note" for a reason: the Fed controls the money supply. It is an independent government agency that conducts monetary policy, which means it sets short-term interest rates — which means it has immense influence over inflation, unemployment, the strength of the dollar and the strength of your wallet. And ever since global credit markets began imploding, its mild-mannered chairman has dramatically expanded those powers and reinvented the Fed.

Professor Bernanke of Princeton was a leading scholar of the Great Depression. He knew how the passive Fed of the 1930s helped create the calamity — through its stubborn refusal to expand the money supply and its tragic lack of imagination and experimentation. Chairman Bernanke of Washington was determined not to be the Fed chairman who presided over Depression 2.0. So when turbulence in U.S. housing markets metastasized into the worst global financial crisis in more than 75 years, he conjured up trillions of new dollars and blasted them into the economy; engineered massive public rescues of failing private companies; ratcheted down interest rates to zero; lent to mutual funds, hedge funds, foreign banks, investment banks, manufacturers, insurers and other borrowers who had never dreamed of receiving Fed cash; jump-started stalled credit markets in everything from car loans to corporate paper; revolutionized housing finance with a breathtaking shopping spree for mortgage bonds; blew up the Fed's balance sheet to three times its previous size; and generally transformed the staid arena of central banking into a stage for desperate improvisation. He didn't just reshape U.S. monetary policy; he led an effort to save the world economy.

No wonder his eyes look tired.

The last Fed chair, Alan Greenspan, inspired an odd cult of personality. Bernanke hoped to return the Fed to dull obscurity. But his aggressive steps to avert doomsday — and his unusually close partnerships with Bush and Obama Treasury Secretaries Henry Paulson and Timothy Geithner — have exposed him and his institution to criticism from all directions. He's Bailout Ben, the patron saint of Wall Street greedheads, or King Ben, the unelected czar of a fourth branch of government. He's soft on inflation, bombarding the country with easy money, or soft on unemployment, ignoring Main Street's cries for even more aggressive action. Bleeding-heart liberals and tea-party reactionaries alike are trying to block his appointment for a second four-year term. Libertarian Congressman Ron Paul is peddling a best seller titled End the Fed. And Congress is considering bills that could strip the Fed of some of its power and independence.

So here he is inside his marble fortress, a technocrat in an ink-stained shirt and an off-the-rack suit, explaining what he's done, where we are and what might happen next.

He knows that the economy is awful, that 10% unemployment is much too high, that Wall Street bankers are greedy ingrates, that Main Street still hurts. Banks are handing out sweet bonuses again but still aren't doing much lending. Technically, the recession is over, but growth has been anemic and heavily reliant on government programs like Cash for Clunkers, not to mention cheap Fed money. "I understand why people are frustrated. I'm frustrated too," Bernanke says. "I'm not one of those people who look at this as some kind of video game. I come from Main Street, from a small town that's really depressed. This is all very real to me."

But Bernanke also knows the economy would be much, much worse if the Fed had not taken such extreme measures to stop the panic. There's a vast difference between 10% and 25% unemployment, between anemic and negative growth. He wishes Americans understood that he helped save the irresponsible giants of Wall Street only to protect ordinary folks on Main Street. He knows better than anyone how financial crises spiral into global disasters, how the grass gets crushed when elephants fall. "We came very, very close to a depression ... The markets were in anaphylactic shock," he told TIME during one of three extended interviews. "I'm not happy with where we are, but it's a lot better than where we could be."

Bernanke also has thoughts about the economy's future — and we'll get to them soon. First, though, we should explain why his face is on the cover of this issue. The overriding story of 2009 was the economy — the lousiness of it, and the fact that it wasn't far lousier. It was a year of escalating layoffs, bankruptcies and foreclosures, the "new frugality" and the "new normal." It was also a year of green shoots, a rebounding Dow and a fragile sense that the worst is over. Even the big political stories of 2009 — the struggles of the Democrats; the tea-party takeover of the Republicans; the stimulus; the deficit; GM and Chrysler; the backlash over bailouts and bonuses; the furious debates over health care, energy and financial regulation; the constant drumbeat of jobs, jobs, jobs — were, at heart, stories about the economy. And it's Bernanke's economy.

In 2009, Bernanke hurled unprecedented amounts of money into the banking system in unprecedented ways, while starting to lay the groundwork for the Fed's eventual return to normality. He helped oversee the financial stress tests that finally calmed the markets, while launching a groundbreaking public relations campaign to demystify the Fed. Now that Obama has decided to keep him in his job, he has become a lightning rod in an intense national debate over the Fed as it approaches its second century.

But the main reason Ben Shalom Bernanke is TIME's Person of the Year for 2009 is that he is the most important player guiding the world's most important economy. His creative leadership helped ensure that 2009 was a period of weak recovery rather than catastrophic depression, and he still wields unrivaled power over our money, our jobs, our savings and our national future. The decisions he has made, and those he has yet to make, will shape the path of our prosperity, the direction of our politics and our relationship to the world.