(5 of 11)

Mercy Hospital is owned by an organization under the umbrella of the Catholic Church called Sisters of Mercy. Its mission, as described in its latest filing with the IRS as a tax-exempt charity, is "to carry out the healing ministry of Jesus by promoting health and wellness." With a chain of 31 hospitals and 300 clinics across the Midwest, Sisters of Mercy uses a bill-collection firm based in Topeka, Kans., called Berlin-Wheeler Inc. Suits against Mercy patients are on file in courts across Oklahoma listing Berlin-Wheeler as the plaintiff. According to its most recent tax return, the Oklahoma City unit of the Sisters of Mercy hospital chain collected $337 million in revenue for the fiscal year ending June 30, 2011. It had an operating profit of $34 million. And that was after paying 10 executives more than $300,000 each, including $784,000 to a regional president and $438,000 to the hospital president.

That report doesn't cover the executives overseeing the chain, called Mercy Health, of which Mercy in Oklahoma City is a part. The overall chain had $4.28 billion in revenue that year. Its hospital in Springfield, Mo. (pop. 160,660), had $880.7 million in revenue and an operating profit of $115 million, according to its federal filing. The incomes of the parent company's executives appear on other IRS filings covering various interlocking Mercy nonprofit corporate entities. Mercy president and CEO Lynn Britton made $1,930,000, and an executive vice president, Myra Aubuchon, was paid $3.7 million, according to the Mercy filing. In all, seven Mercy Health executives were paid more than $1 million each. A note at the end of an Ernst & Young audit that is attached to Mercy's IRS filing reported that the chain provided charity care worth 3.2% of its revenue in the previous year. However, the auditors state that the value of that care is based on the charges on all the bills, not the actual cost to Mercy of providing those services — in other words, the chargemaster value. Assuming that Mercy's actual costs are a tenth of these chargemaster values — they're probably less — all of this charity care actually cost Mercy about three-tenths of 1% of its revenue, or about $13 million out of $4.28 billion.

Mercy's website lists an 18-member media team; one member, Rachel Wright, told me that neither CEO Britton nor anyone else would be available to answer questions about compensation, the hospital's bill-collecting activities through Berlin-Wheeler or Steve H.'s bill, which I had sent her (with his name and the date of his visit to the hospital redacted to protect his privacy).

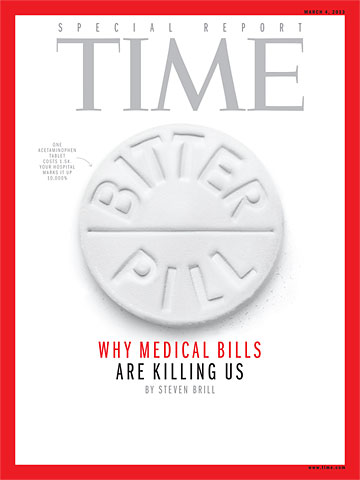

Photograph by Nick Veasey for TIME

Bacitracin: $108 Charge for the common antibiotic ointment that appeared on a patient's bill under the hard-to-parse category "Pharmacy General Classification"

Wright said the hospital's lawyers had decided that discussing Steve H.'s bill would violate the federal HIPAA law protecting the privacy of patient medical records. I pointed out that I wanted to ask questions only about the hospital's charges for standard items — such as surgical gowns, basic blood tests, blanket warmers and even medical devices — that had nothing to do with individual patients. "Everything is particular to an individual patient's needs," she replied. Even a surgical gown? "Yes, even a surgical gown. We cannot discuss this with you. It's against the law." She declined to put me in touch with the hospital's lawyers to discuss their legal analysis.

Hiding behind a privacy statute to avoid talking about how it prices surgeons' gowns may be a stretch, but Mercy might have a valid legal reason not to discuss what it paid for the Medtronic device before selling it to Steve H. for $49,237. Pharmaceutical and medical-device companies routinely insert clauses in their sales contracts prohibiting hospitals from sharing information about what they pay and the discounts they receive. In January 2012, a report by the federal Government Accountability Office found that "the lack of price transparency and the substantial variation in amounts hospitals pay for some IMD [implantable medical devices] raise questions about whether hospitals are achieving the best prices possible."

A lack of price transparency was not the only potential market inefficiency the GAO found. "Although physicians are not involved in price negotiations, they often express strong preferences for certain manufacturers and models of IMD," the GAO reported. "To the extent that physicians in the same hospitals have different preferences for IMDs, it may be difficult for the hospital to obtain volume discounts from particular manufacturers."

"Doctors have no incentive to buy one kind of hip or other implantable device as a group," explains Ezekiel Emanuel, an oncologist and a vice provost of the University of Pennsylvania who was a key White House adviser when Obamacare was created. "Even in the most innocent of circumstances, it kills the chance for market efficiencies."

The circumstances are not always innocent. In 2008, Gregory Demske, an assistant inspector general at the Department of Health and Human Services, told a Senate committee that "physicians routinely receive substantial compensation from medical-device companies through stock options, royalty agreements, consulting agreements, research grants and fellowships."

The assistant inspector general then revealed startling numbers about the extent of those payments: "We found that during the years 2002 through 2006, four manufacturers, which controlled almost 75% of the hip- and knee-replacement market, paid physician consultants over $800 million under the terms of roughly 6,500 consulting agreements."

Other doctors, Demske noted, had stretched the conflict of interest beyond consulting fees: "Additionally, physician ownership of medical-device manufacturers and related businesses appears to be a growing trend in the medical-device sector ... In some cases, physicians could receive substantial returns while contributing little to the venture beyond the ability to generate business for the venture." In 2010, Medtronic, along with several other members of a medical-technology trade group, began to make the potential conflicts transparent by posting all payments to physicians on a section of its website called Physician Collaboration. The voluntary move came just before a similar disclosure regulation promulgated by the Obama Administration went into effect governing any doctor who receives funds from Medicare or the National Institutes of Health (which would include most doctors). And the nonprofit public-interest-journalism organization ProPublica has smartly organized data on doctor payments on its website. The conflicts have not been eliminated, but they are being aired, albeit on searchable websites rather than through a requirement that doctors disclose them to patients directly.

But conflicts that may encourage devices to be overprescribed or that lead doctors to prescribe a more expensive one instead of another are not the core problem in this marketplace. The more fundamental disconnect is that there is little reason to believe that what Mercy Hospital paid Medtronic for Steve H.'s device would have had any bearing on what the hospital decided to charge Steve H. Why would it? He did not know the price in advance.

Besides, studies delving into the economics of the medical marketplace consistently find that a moderately higher or lower price doesn't change consumer purchasing decisions much, if at all, because in health care there is little of the price sensitivity found in conventional marketplaces, even on the rare occasion that patients know the cost in advance. If you were in pain or in danger of dying, would you turn down treatment at a price 5% or 20% higher than the price you might have expected — that is, if you'd had any informed way to know what to expect in the first place, which you didn't?

The question of how sensitive patients will be to increased prices for medical devices recently came up in a different context. Aware of the huge profits being accumulated by devicemakers, Obama Administration officials decided to recapture some of the money by imposing a 2.39% federal excise tax on the sales of these devices as well as other medical technology such as CT-scan equipment. The rationale was that getting back some of these generous profits was a fair way to cover some of the cost of the subsidized, broader insurance coverage provided by Obamacare — insurance that in some cases will pay for more of the devices. The industry has since geared up in Washington and is pushing legislation that would repeal the tax. Its main argument is that a 2.39% increase in prices would so reduce sales that it would wipe out a substantial portion of what the industry claims are the 422,000 jobs it supports in a $136 billion industry.

That prediction of doom brought on by this small tax contradicts the reams of studies documenting consumer price insensitivity in the health care marketplace. It also ignores profit-margin data collected by McKinsey that demonstrates that devicemakers have an open field in the current medical ecosystem. A 2011 McKinsey survey for medical-industry clients reported that devicemakers are superstar performers in a booming medical economy. Medtronic, which performed in the middle of the group, delivered an amazing compounded annual return of 14.95% to shareholders from 1990 to 2010. That means $100 invested in the company in 1990 was worth $1,622 20 years later. So if the extra 2.39% would be so disruptive to the market for products like Medtronic's that it would kill sales, why would the industry pass it along as a price increase to consumers? It hardly has to, given its profit margins.

Medtronic spokeswoman Donna Marquad says that for competitive reasons, her company will not discuss sales figures or the profit on Steve H.'s neurostimulator. But Medtronic's October 2012 quarterly SEC filing reported that its spine "products and therapies," which presumably include Steve H.'s device, "continue to gain broad surgeon acceptance" and that its cost to make all of its products was 24.9% of what it sells them for.

That's an unusually high gross profit margin — 75.1% — for a company that manufactures real physical products. Apple also produces high-end, high-tech products, and its gross margin is 40%. If the neurostimulator enjoys that company-wide profit margin, it would mean that if Medtronic was paid $19,000 by Mercy Hospital, Medtronic's cost was about $4,500 and it made a gross profit of about $14,500 before expenses for sales, overhead and management — including CEO Omar Ishrak's compensation, which was $25 million for the 2012 fiscal year.

Mercy's Bargain When Pat Palmer, the medical-billing specialist who advises Steve H.'s union, was given the Mercy bill to deal with, she prepared a tally of about $4,000 worth of line items that she thought represented the most egregious charges, such as the surgical gown, the blanket warmer and the marking pen. She restricted her list to those she thought were plainly not allowable. "I didn't dispute nearly all of them," she says. "Because then they get their backs up."

The hospital quickly conceded those items. For the remaining $83,000, Palmer invoked a 40% discount off chargemaster rates that Mercy allows for smaller insurance providers like the union. That cut the bill to about $50,000, for which the insurance company owed 80%, or about $40,000. That left Steve H. with a $10,000 bill.

Sean Recchi wasn't as fortunate. His bill — which included not only the aggressively marked-up charge of $13,702 for the Rituxan cancer drug but also the usual array of chargemaster fees for basics like generic Tylenol, blood tests and simple supplies — had one item not found on any other bill I examined: MD Anderson's charge of $7 each for "ALCOHOL PREP PAD." This is a little square of cotton used to apply alcohol to an injection. A box of 200 can be bought online for $1.91.

We have seen that to the extent that most hospital administrators defend such chargemaster rates at all, they maintain that they are just starting points for a negotiation. But patients don't typically know they are in a negotiation when they enter the hospital, nor do hospitals let them know that. And in any case, at MD Anderson, the Recchis were made to pay every penny of the chargemaster bill up front because their insurance was deemed inadequate. That left Penne, the hospital spokeswoman, with only this defense for the most blatantly abusive charges for items like the alcohol squares: "It is difficult to compare a retail store charge for a common product with a cancer center that provides the item as part of its highly specialized and personalized care," she wrote in an e-mail. Yet the hospital also charges for that "specialized and personalized" care through, among other items, its $1,791-a-day room charge.

Before MD Anderson marked up Recchi's Rituxan to $13,702, the profit taking was equally aggressive, and equally routine, at the beginning of the supply chain — at the drug company. Rituxan is a prime product of Biogen Idec, a company with $5.5 billion in annual sales. Its CEO, George Scangos, was paid $11,331,441 in 2011, a 20% boost over his 2010 income. Rituxan is made and sold by Biogen Idec in partnership with Genentech, a South San Francisco–based biotechnology pioneer. Genentech brags about Rituxan on its website, as did Roche, Genentech's $45 billion parent, in its latest annual report. And in an Investor Day presentation last September, Roche CEO Severin Schwann stressed that his company is able to keep prices and margins high because of its focus on "medically differentiated therapies." Rituxan, a cancer wonder drug, certainly meets that test.

The original version of this article gave an incorrect 2011 profit figure for Mercy Hospital in Springfield, Mo. It should have been $115 million, not $319 million.