(2 of 11)

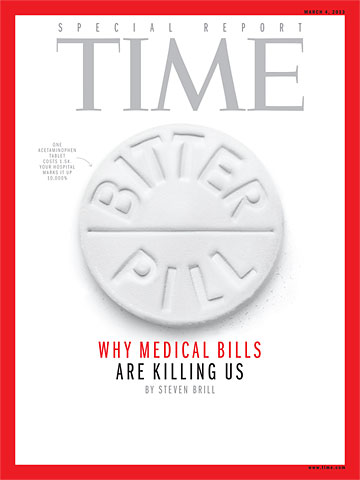

Breaking these trillions down into real bills going to real patients cuts through the ideological debate over health care policy. By dissecting the bills that people like Sean Recchi face, we can see exactly how and why we are overspending, where the money is going and how to get it back. We just have to follow the money.

The $21,000 Heartburn Bill One night last summer at her home near Stamford, Conn., a 64-year-old former sales clerk whom I'll call Janice S. felt chest pains. She was taken four miles by ambulance to the emergency room at Stamford Hospital, officially a nonprofit institution. After about three hours of tests and some brief encounters with a doctor, she was told she had indigestion and sent home. That was the good news.

The bad news was the bill: $995 for the ambulance ride, $3,000 for the doctors and $17,000 for the hospital — in sum, $21,000 for a false alarm.

Out of work for a year, Janice S. had no insurance. Among the hospital's charges were three "TROPONIN I" tests for $199.50 each. According to a National Institutes of Health website, a troponin test "measures the levels of certain proteins in the blood" whose release from the heart is a strong indicator of a heart attack. Some labs like to have the test done at intervals, so the fact that Janice S. got three of them is not necessarily an issue. The price is the problem. Stamford Hospital spokesman Scott Orstad told me that the $199.50 figure for the troponin test was taken from what he called the hospital's chargemaster. The chargemaster, I learned, is every hospital's internal price list. Decades ago it was a document the size of a phone book; now it's a massive computer file, thousands of items long, maintained by every hospital.

Stamford Hospital's chargemaster assigns prices to everything, including Janice S.'s blood tests. It would seem to be an important document. However, I quickly found that although every hospital has a chargemaster, officials treat it as if it were an eccentric uncle living in the attic. Whenever I asked, they deflected all conversation away from it. They even argued that it is irrelevant. I soon found that they have good reason to hope that outsiders pay no attention to the chargemaster or the process that produces it. For there seems to be no process, no rationale, behind the core document that is the basis for hundreds of billions of dollars in health care bills.

Because she was 64, not 65, Janice S. was not on Medicare. But seeing what Medicare would have paid Stamford Hospital for the troponin test if she had been a year older shines a bright light on the role the chargemaster plays in our national medical crisis — and helps us understand the illegitimacy of that $199.50 charge. That's because Medicare collects troves of data on what every type of treatment, test and other service costs hospitals to deliver. Medicare takes seriously the notion that nonprofit hospitals should be paid for all their costs but actually be nonprofit after their calculation. Thus, under the law, Medicare is supposed to reimburse hospitals for any given service, factoring in not only direct costs but also allocated expenses such as overhead, capital expenses, executive salaries, insurance, differences in regional costs of living and even the education of medical students.

It turns out that Medicare would have paid Stamford $13.94 for each troponin test rather than the $199.50 Janice S. was charged.

Janice S. was also charged $157.61 for a CBC — the complete blood count that those of us who are ER aficionados remember George Clooney ordering several times a night. Medicare pays $11.02 for a CBC in Connecticut. Hospital finance people argue vehemently that Medicare doesn't pay enough and that they lose as much as 10% on an average Medicare patient. But even if the Medicare price should be, say, 10% higher, it's a long way from $11.02 plus 10% to $157.61. Yes, every hospital administrator grouses about Medicare's payment rates — rates that are supervised by a Congress that is heavily lobbied by the American Hospital Association, which spent $1,859,041 on lobbyists in 2012. But an annual expense report that Stamford Hospital is required to file with the federal Department of Health and Human Services offers evidence that Medicare's rates for the services Janice S. received are on the mark. According to the hospital's latest filing (covering 2010), its total expenses for laboratory work (like Janice S.'s blood tests) in the 12 months covered by the report were $27.5 million. Its total charges were $293.2 million. That means it charged about 11 times its costs. As we examine other bills, we'll see that like Medicare patients, the large portion of hospital patients who have private health insurance also get discounts off the listed chargemaster figures, assuming the hospital and insurance company have negotiated to include the hospital in the insurer's network of providers that its customers can use. The insurance discounts are not nearly as steep as the Medicare markdowns, which means that even the discounted insurance-company rates fuel profits at these officially nonprofit hospitals. Those profits are further boosted by payments from the tens of millions of patients who, like the unemployed Janice S., have no insurance or whose insurance does not apply because the patient has exceeded the coverage limits. These patients are asked to pay the chargemaster list prices.

If you are confused by the notion that those least able to pay are the ones singled out to pay the highest rates, welcome to the American medical marketplace.

Test Strips Patient was charged $18 each for Accu-chek diabetes test strips. Amazon sells boxes of 50 for about $27, or 55¢ each

Pay No Attention To the Chargemaster No hospital's chargemaster prices are consistent with those of any other hospital, nor do they seem to be based on anything objective — like cost — that any hospital executive I spoke with was able to explain. "They were set in cement a long time ago and just keep going up almost automatically," says one hospital chief financial officer with a shrug.

At Stamford Hospital I got the first of many brush-offs when I asked about the chargemaster rates on Janice S.'s bill. "Those are not our real rates," protested hospital spokesman Orstad when I asked him to make hospital CEO Brian Grissler available to explain Janice S.'s bill, in particular the blood-test charges. "It's a list we use internally in certain cases, but most people never pay those prices. I doubt that Brian [Grissler] has even seen the list in years. So I'm not sure why you care."

Orstad also refused to comment on any of the specifics in Janice S.'s bill, including the seemingly inflated charges for all the lab work. "I've told you I don't think a bill like this is relevant," he explained. "Very few people actually pay those rates."

But Janice S. was asked to pay them. Moreover, the chargemaster rates are relevant, even for those unlike her who have insurance. Insurers with the most leverage, because they have the most customers to offer a hospital that needs patients, will try to negotiate prices 30% to 50% above the Medicare rates rather than discounts off the sky-high chargemaster rates. But insurers are increasingly losing leverage because hospitals are consolidating by buying doctors' practices and even rival hospitals. In that situation — in which the insurer needs the hospital more than the hospital needs the insurer — the pricing negotiation will be over discounts that work down from the chargemaster prices rather than up from what Medicare would pay. Getting a 50% or even 60% discount off the chargemaster price of an item that costs $13 and lists for $199.50 is still no bargain. "We hate to negotiate off of the chargemaster, but we have to do it a lot now," says Edward Wardell, a lawyer for the giant health-insurance provider Aetna Inc.

That so few consumers seem to be aware of the chargemaster demonstrates how well the health care industry has steered the debate from why bills are so high to who should pay them.

The expensive technology deployed on Janice S. was a bigger factor in her bill than the lab tests. An "NM MYO REST/SPEC EJCT MOT MUL" was billed at $7,997.54. That's a stress test using a radioactive dye that is tracked by an X-ray computed tomography, or CT, scan. Medicare would have paid Stamford $554 for that test.

Janice S. was charged an additional $872.44 just for the dye used in the test. The regular stress test patients are more familiar with, in which arteries are monitored electronically with an electrocardiograph, would have cost far less — $1,200 even at the hospital's chargemaster price. (Medicare would have paid $96 for it.) And although many doctors view the version using the CT scan as more thorough, others consider it unnecessary in most cases.

According to Jack Lewin, a cardiologist and former CEO of the American College of Cardiology, "It depends on the patient, of course, but in most cases you would start with a standard stress test. We are doing too many of these nuclear tests. It is not being used appropriately ... Sometimes a cardiogram is enough, and you don't even need the simpler test. But it usually makes sense to give the patient the simpler one first and then use nuclear for a closer look if there seem to be problems."

We don't know the particulars of Janice S.'s condition, so we cannot know why the doctors who treated her ordered the more expensive test. But the incentives are clear. On the basis of market prices, Stamford probably paid about $250,000 for the CT equipment in its operating room. It costs little to operate, so the more it can be used and billed, the quicker the hospital recovers its costs and begins profiting from its purchase. In addition, the cardiologist in the emergency room gave Janice S. a separate bill for $600 to read the test results on top of the $342 he charged for examining her.

According to a McKinsey study of the medical marketplace, a typical piece of equipment will pay for itself in one year if it carries out just 10 to 15 procedures a day. That's a terrific return on capital equipment that has an expected life span of seven to 10 years. And it means that after a year, every scan ordered by a doctor in the Stamford Hospital emergency room would mean pure profit, less maintenance costs, for the hospital. Plus an extra fee for the doctor.

Another McKinsey report found that health care providers in the U.S. conduct far more CT tests per capita than those in any other country — 71% more than in Germany, for example, where the government-run health care system offers none of those incentives for overtesting. We also pay a lot more for each test, even when it's Medicare doing the paying. Medicare reimburses hospitals and clinics an average of four times as much as Germany does for CT scans, according to the data gathered by McKinsey.

Medicare's reimbursement formulas for these tests are regulated by Congress. So too are restrictions on what Medicare can do to limit the use of CT and magnetic resonance imaging (MRI) scans when they might not be medically necessary. Standing at the ready to make sure Congress keeps Medicare at bay is, among other groups, the American College of Radiology, which on Nov. 14 ran a full-page ad in the Capitol Hill–centric newspaper Politico urging Congress to pass the Diagnostic Imaging Services Access Protection Act. It's a bill that would block efforts by Medicare to discourage doctors from ordering multiple CT scans on the same patient by paying them less per test to read multiple tests of the same patient. (In fact, six of Politico's 12 pages of ads that day were bought by medical interests urging Congress to spend or not cut back on one of their products.)

The costs associated with high-tech tests are likely to accelerate. McKinsey found that the more CT and MRI scanners are out there, the more doctors use them. In 1997 there were fewer than 3,000 machines available, and they completed an average of 3,800 scans per year. By 2006 there were more than 10,000 in use, and they completed an average of 6,100 per year. According to a study in the Annals of Emergency Medicine, the use of CT scans in America's emergency rooms "has more than quadrupled in recent decades." As one former emergency-room doctor puts it, "Giving out CT scans like candy in the ER is the equivalent of putting a 90-year-old grandmother through a pat-down at the airport: Hey, you never know."

Selling this equipment to hospitals — which has become a key profit center for industrial conglomerates like General Electric and Siemens — is one of the U.S. economy's bright spots. I recently subscribed to an online headhunter's listings for medical-equipment salesmen and quickly found an opening in Connecticut that would pay a salary of $85,000 and sales commissions of up to $95,000 more, plus a car allowance. The only requirement was that applicants have "at least one year of experience selling some form of capital equipment."

In all, on the day I signed up for that jobs website, it carried 186 listings for medical-equipment salespeople just in Connecticut.