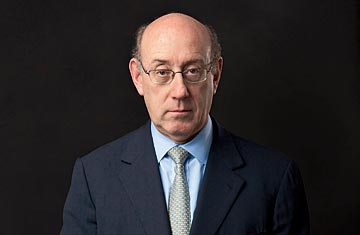

Ken Feinberg

(2 of 3)

That's just the start. Feinberg will oversee the pay at the firms until each has repaid the government--or until he quits, and he has no plans to do so anytime soon. Having established a set of principles on which to base compensation for these execs, Feinberg says it will be easier to pass judgment on next year's pay packages, a process he pledges to start in January.

So how does one man evaluate the worth of 700 others? Feinberg asked each company to submit pay proposals for their top 25 executives. Officials at six of the seven asked him to approve base-salary raises for their top guns. He was stunned. "What I learned in this job already is that the gap between what Wall Street thinks is a reasonable paycheck and what Main Street thinks these officials should get is not a gap. It's a chasm," he says.

Feinberg had the seven firms disclose what the executives in question earned in the past two years. He then collected data on top executives' salaries in the auto and financial industries. None of those at the bailed-out firms, in Feinberg's view, should receive more than the average pay for that position in their industry. Then he got feedback from within the firms on how well each individual did his job.

He says in general, the companies have cooperated. But there has been tension. Feinberg asked all the firms to report how much stock each of their executives held, a point that a number of execs said might call into question their loyalty to their firm. AIG and a number of its top earners refused to give back past bonuses or rewrite contracts that guarantee multimillion-dollar bonuses at the insurer next year. And a number of companies insisted that his plan would hurt their ability to attract and retain talent.

Cutting the Check

In the end, he made more changes to the way executives get paid than to how much. That has disappointed some critics. Feinberg ended up boosting many of the executives' base salaries from last year's, though not as much as the firms requested. Total compensation dropped, but to most people, it will look like Wall Street pay as usual. Eight of the 12 highest-paid executives at Bank of America will get more than $5 million for their work in 2009. At Citigroup, 14 execs will get at least that much.

Feinberg's big changes are in the form of payment, particularly on Wall Street. Gone are year-end payouts and AIG-style guaranteed retention awards. Instead, he devised a method of compensating executives: something he calls salary stock. Each pay period, the executives at Bank of America, GM and the other firms will get awards of stock along with their regular paychecks. The checks can be cashed immediately, but the executives may not sell the stock for up to four years. Also, bonuses are paid in restricted stock, which must be held for at least three years and may be sold only after the firm has repaid what it owes taxpayers. The result is that in most cases, much of what the executives will get paid--in some instances, nearly 95%--will be in long-term stock grants. For the most part, Feinberg has kept cash salaries to $500,000 or less.