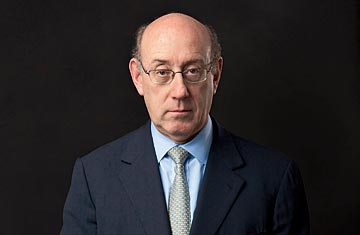

Ken Feinberg

Ken Feinberg is a close talker. Feinberg, a lawyer who in June was named the Treasury Department's special master for executive compensation, starts his sentences about 18 inches from your face and, with a thick Boston accent, leans in to make his point.

It's an unusual trait for a guy who has to deliver the type of news that most of us would prefer to dispense from across the room or, better yet, by e-mail from a do-not-reply address. On Oct. 22, he told 136 top executives of seven bailed-out firms that effective immediately, he was cutting their total compensation 50% from what they received a year ago. Feinberg's previous public position was the administrator of the September 11th Victim Compensation Fund. In that job, he had to put a price tag on the dead.

"Dollars are a surrogate for worth," says Feinberg, leaning back in his chair before bouncing forward again on the next sentence. "So when you start talking about dollars, what people hear is a ruling on their overall integrity and value to society. It gets difficult."

Feinberg, 64, holds a unique position in American society. He decides what people--their pain as well as their day-to-day roles--are worth. Appointed 25 years ago to distribute about $200 million to Vietnam vets poisoned by the herbicide Agent Orange, he has become the Solomon of settlement. As head of the 9/11 fund, he held town-hall meetings and met one on one with countless grieving relatives to explain his bottom line on the lost years of mothers and fathers and daughters and sons. "He recognized the astounding amount of sensitivity of the assignment," says former Senator Charles Hagel, who supported Feinberg for the position. "By all the different assessments you can take of these things--victims' reactions, cost to the taxpayer, political issues--he did a great job with the 9/11 fund."

His current task may be even more complex. Feinberg's mid-October report reassessed not only what the top 25 executives of each of the seven firms that received the most government assistance should be paid but also how. Unlike his job with the 9/11 fund, Feinberg's position as pay czar is not one that inspires sympathy. Some think his meddling has made the firms over which he has sway less competitive. Others say he didn't cut enough. But as Wall Street prepares to hand out eye-popping year-end bonuses, the larger question is this: Just how much does it matter what people are paid? "Where is the empirical evidence that by doing what Feinberg is doing, we'll solve the problems that caused the financial crisis?" asks Ohio State University finance professor René Stulz, who has looked at whether excessive CEO pay caused the credit crunch. "I don't see it."

The Job at Hand

The treasury established Feinberg's position after Congress passed the American Recovery and Reinvestment Act in February. Feinberg has jurisdiction over the 100 highest-paid employees at the seven firms that the government deemed "exceptional assistance recipients": insurer AIG, financial firms Bank of America and Citigroup, auto companies Chrysler and General Motors and their former finance arms Chrysler Financial and GMAC.