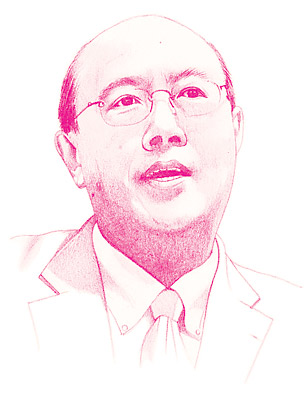

If Adam Smith had a mind meld with Charles Darwin, Andrew Lo might result. A professor at MIT's Sloan School of Management, Lo is known for his multidisciplinary approach to finance, using everything from statistical analysis to neuroscience to better understand the markets. One of his most important ideas involves the "adaptive markets" theory.

For a long time, many economists believed in the "rational markets" theory, which posited that all available information was reflected in a stock's price and investors were rational — and so, therefore, were prices (yeah, right). Lo, 52, believes markets are less like rule-based physics and more like messy biological systems. Market participants aren't coldly rational creatures but squirmy, evolving species interacting with one another in a primordial sludge of money.

By tracking the data trails left by this Darwinian process, we might be able to get a better picture of how markets really work. The U.S. Treasury buys it; Lo helped set up the new Office of Financial Research, which aims to provide better data and insights about the industry. "Policymakers are always looking for the financial-system equivalent of the MRI," said Treasury Secretary Tim Geithner at the launch of the OFR last year. Digging in the financial dirt may be the way to get it.

Foroohar is TIME's economics editor