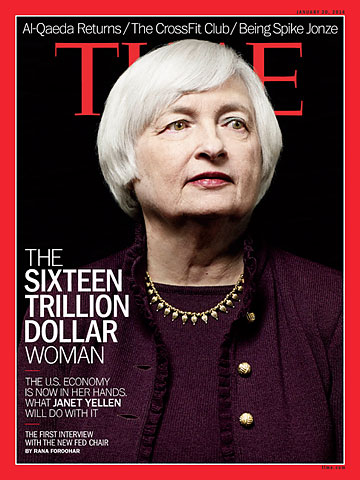

(2 of 7)

Yellen, who is nothing if not evenhanded, says that she is doing her very best to meet these weighty challenges--and that things are looking up for America. In an exclusive interview on the day of her Senate confirmation, Yellen told TIME she believes 2014 is going to be a year of improvement for the U.S. economy: "I think we'll see stronger growth this year. Most of my colleagues on the Fed's policymaking committee and I are hopeful that the first digit [of GDP growth] could be 3 rather than 2." (The U.S. economy grew at a sluggish 2% on average for most of 2013.) Yellen also thinks the housing market is headed in the right direction again after a brief lull last fall: "I expect it to pick back up, and I do expect a further recovery." She's also hopeful that consumers will start spending more, businesses will invest and hire at a faster clip and that all those "fiscal headwinds" the Fed communiqués are always referring to are finally abating. Adding a moderating beat, Yellen concludes, "The recovery has been frustratingly slow, but we're making progress in getting people back to work, and I anticipate that inflation will move back toward our longer-run goal of 2%."

The Fed, which turns 101 this year, is at little risk right now of compromising its dual mandate of keeping both unemployment and inflation low, a mandate that Yellen stresses she's steadfastly committed to. That's because inflation remains weak, a symptom of a recovery that's only just gaining steam after 4½ years. "I worked with Chairman [Ben] Bernanke and others at the Fed to put together a statement where we talk about how we understand our dual goals. They're both on the table as equals." But right now, Yellen stresses, her first priority is getting unemployment down from its current 7% level, eventually as far down as the 5.2% to 5.8% that Fed policymakers believe represents full American employment these days. "I'd like to see real wages going up," Yellen says, adding that the average American male worker's inflation-adjusted wages have been flat or down for the past 20 years.

Those words may not sound uncommon, but in an institution where people often speak in algorithms rather than English and live in a statistical bubble, Yellen's focus on the human impact of economics is a true shift. Central bankers have, as she puts it, "an important role in public policy and a moral responsibility to take part in it." The job, as she sees it, "isn't just about fighting inflation or monitoring the financial system. It's about trying to help ordinary households get back on their feet and about creating a labor market where people can feel secure and work and get ahead."

KITCHEN-TABLE ECONOMICS

Yellen graduated in 1963 from her Brooklyn high school as valedictorian. But her career epiphany came during her first macroeconomics class at Brown University. "I was interested in math, and I think very logically, and I remember sitting in that class and learning about how there were policy decisions that could have been taken during the Great Depression to alleviate all that human suffering--that was a real 'aha' moment for me. I realized that public policy can, and should, address these problems."