(2 of 3)

You've heard, of course, that subprime mortgages--subprime is Wall Street's euphemism for junk--are where the problems started. That's true, but the problems have now spread way beyond them. Those predicting that the housing hiccup wouldn't be a big deal--what's a few hundred billion in crummy mortgage loans compared with a $13 trillion U.S. economy or a $54 trillion world economy?--failed to grasp that possibility. It turned out that Wall Street's greed--and by Wall Street, we mean the world of money and investments, not a geographic area in downtown Manhattan--was supplemented by ignorance. Folks in the world of finance created, bought, sold and traded securities that were too complex for them to fully understand. (Try analyzing a CDO-squared sometime. Good luck.)

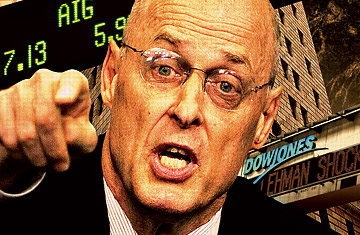

For an example in our backyard, consider Lehman Brothers. Lehman was so flush, or at least felt so flush, that in May 2007 it sublet 12 prime midtown-Manhattan floors of the Time & Life Building--across the street from Lehman headquarters--from Time Inc., which publishes this magazine. Lehman signed on for $350 million over 10 years. (It's not clear what kind of hit, if any, Time Inc. will now face.)

Lehman's fall shows the downside of using borrowed money. Even though Lehman has a 158-year-old name, it's actually a 14-year-old company that was spun off by American Express in 1994. AmEx had gobbled it up 10 years earlier, and it wasn't in prime shape when AmEx spat it out. To compensate for its relatively small size and skinny capital base, Lehman took risks that proved too large. To keep profits growing, Lehman borrowed huge sums relative to its size. Its debts were about 35 times its capital, far higher than its peer group's ratio. And it plunged heavily into real estate ventures that cratered.

Here's how leverage works in reverse. When things go well, as they did until last year, Lehman is immensely profitable. If you borrow 35 times your capital and those investments rise only 1%, you've made 35% on your money. If, however, things move against you--as they did with Lehman--a 1% or 2% drop in the value of your assets puts your future in doubt. The firm increasingly relied on investments in derivatives to produce profits, in essence creating a financial arms race with competitors like Goldman Sachs. Even though the Fed had set up a special borrowing program for Lehman and other investment banks after the forced sale of Bear Stearns to JPMorgan Chase in March, the market ultimately lost faith in Lehman. So out it went.

Uncle Sam Steps Back In

The market lost faith in AIG too, but the government was forced to save it. A major reason is that AIG is one of the creators of the aforementioned credit-default swaps. What are those, you ask? They're pixie-dust securities that supposedly offer insurance against a company defaulting on its obligations. If you buy $10 million of GM bonds, for instance, you might hedge your bet by buying a $10 million CDS from AIG. In return for that premium--which changes day to day--AIG agrees to give you $10 million should GM have an "event of default" on its obligations.

But as a way to make sure that swap meisters can make good on their obligations, they have to post collateral. If their credit is downgraded--as was the case with AIG--they have to post more collateral. What put AIG on the brink was that it had to post $14 billion overnight, which of course it didn't have lying around. Next week, the looming downgrades might have forced it to come up with $250 billion. (No, that's not a typographical mistake; it's a real number.) Hence the action. If AIG croaked, all the players who thought they had their bets hedged would suddenly have "unbalanced books." That could lead to firms other than AIG failing, which could lead to still more firms failing, which could lead to what economists call "systemic failure." Or, in plain terms, a financial death spiral in which firms suck one another into the abyss.

AIG, like Lehman, was ultimately done in by credit-rating agencies, of all things. The main credit raters--Moody's and Standard & Poor's--had blithely assigned top-drawer AAA and AA ratings to all sorts of hinky mortgage securities and other financial esoterica without understanding the risks involved. Would you know how to rate a collateralized loan obligation? Or commercial-mortgage-backed securities? Sophisticated investors took Moody's and S&P's word for it, and it turned out that the agencies didn't know what they were doing. Credit raters, who claim to offer only opinions, are party to Wall Street's cycles too. At the beginning, they're far too lenient with borrowers, who are the ones who pay their rating fees. Then, after a couple of embarrassments--remember Enron and WorldCom?--the raters tighten up, maybe too much. Then memory fades, and the cycle repeats.

What doomed AIG was the rating agencies' decision--they had suddenly awakened to AIG's problems--to sharply downgrade the firm's securities. That gave AIG no time to react, no time to raise more capital, no more time to do anything else but beg for help. Because AIG is in a much scarier situation than Lehman--the insurer has assets of $1 trillion, more than 70 million customers and intimate back-and-forth dealings with many of the world's biggest and most important financial firms--Uncle Sam felt that it had no choice but to intervene.

Right before the markets began to unravel last year, Lloyd Blankfein, chief executive of Goldman Sachs, presciently quipped that he hadn't "felt this good since 1998," referring to the Wall Street wipeout precipitated that year by Russia's defaulting on its ruble debt. Blankfein argued that confidence in global markets had built up to a dangerously giddy level and that investors weren't being compensated for assuming outsize risk in securities like esoteric bonds and Chinese stocks. Blankfein was right, of course, but even he wasn't paranoid enough. Though Goldman stands, along with Morgan Stanley, as one of the last two giant U.S. investment banks not to collapse (as Lehman and Bear Stearns have) or be sold (à la Merrill Lynch), Goldman too has been pummeled. The firm's quarterly profit plunged 70%--results considered to be relatively good. While analysts generally believe that Goldman and Morgan Stanley will survive the meltdown, that view is not unanimous. Says doomster New York University economics professor Nouriel Roubini: "They will be gone in a matter of months as well. It's better if Goldman or Morgan Stanley find a buyer, because their business model is fundamentally flawed." Both firms would beg to disagree, but their stock prices have been hammered.