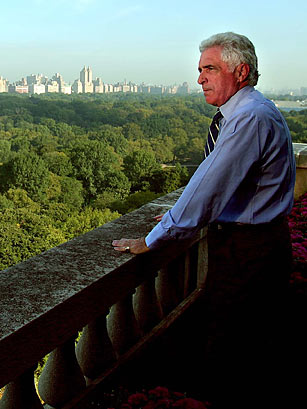

Theodore J. Forstmann, the Wall Street dealmaker and private equity pioneer who made billions in leveraged buyouts only to become one of the practice's most vocal critics, died Nov. 19 in New York City, just months after being diagnosed with brain cancer.

The scion of Connecticut royalty — his grandfather, the owner of Forstmann Woolen Co., was once one of the world's richest men — Forstmann played amateur tennis and hockey at Yale; after the family business failed, he put himself through Columbia Law School by betting at high-stakes bridge. With money scraped together and a secretary borrowed from his brother's financial firm, he co-founded the investment company Forstmann Little in 1978, which quickly made a name for itself in the increasingly fashionable leveraged buyout business, using debt to acquire a company in order to break it up or resell it quickly for a profit. He was, by all accounts, brilliant at it: Forstmann Little averaged 50% annual returns over its first two decades, snapping up and turning around companies including Dr. Pepper, General Instruments and Gulfstream Aerospace. (After its successful sale to GE for nearly $5 billion more than he had paid for it, Gulfstream reportedly rewarded Forstmann with a $40 million jet.) But Forstmann soured on the LBO business as the deals grew bigger and were increasingly financed by junk bonds — risky investments that he believed were ruining the industry. "Watching these deals get done," he wrote in a 1988 op-ed in the Wall Street Journal, "is like watching a herd of drunk drivers take to the highway on New Year's Eve." He even coined the term that became synonymous with the '80s LBO boom — "barbarians at the gate" — a remark that became the title of a 1990 bestseller about his $25 billion battle with junk-bond virtuosos Kohlberg Kravis Roberts & Co. for control of RJR Nabisco. (He lost.)

With a personal net worth estimated at $1.8 billion, Forstmann donated vast sums to children's charities and adopted two boys from South Africa, but never married — although he was romantically linked, at one point or another, to Diana, Princess of Wales, actress Elizabeth Hurley and Top Chef host Padma Lakshmi. Combining his interests in athletics and dealmaking, Forstmann's last role was as chairman of the sports management firm IMG, which he developed from a boutique talent agency into a worldwide marketing giant with interests in everything from Indian cricket to New York Fashion Week.