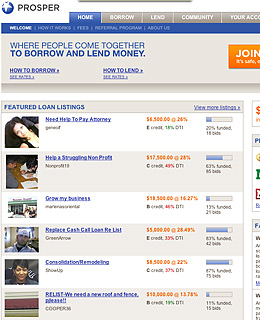

Prosper.com

Prosper is a community of lenders and borrowers—or social lending network—operates outside of any bank, so the rates are better. Post a request for a loan, including desired amount and the maximum interest rate you'd be willing to pay; potential lenders place bids for the amount they are willing to lend, and at what rate. Prosper combines the best offers and puts together a loan plan (multiple lenders, lower risk) and manages the repayment over three years (the standard term). The site also does credit checks, and charges transaction fees and servicing fees.

Prosper loans are not secured by collateral, but the loan agreements are legally binding. You can join a group to get the benefit of that group's positive payment history; as a member of a group, your timely payments help improve the group's overall rep, and that can lead to lower rates for everybody. There are loads of rules for borrowers and lenders—members are forbidden to arrange loans outside the Prosper marketplace, for example—and violations can get you booted. Zopa based in the U.K., operates along similar lines (and its site has prettier graphics) but its network is not as big as Prosper's, which boasts more than 300,000 members and nearly $66 million in active loans. Also worth noting: CircleLending which helps manage private loans between relatives and friends.