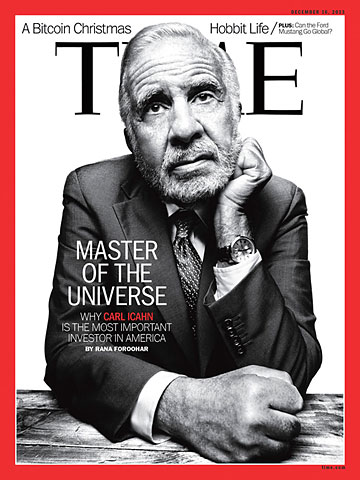

Carl Icahn is the richest man on Wall Street. He's the most feared corporate raider in the world. He may also be the most entertaining financier on the planet. Having grown up in a family that resembled a darker version of Woody Allen's multigenerational working-class Jewish clan in Radio Days, Icahn is prone to one-liners. (His oft-repeated riff on why he's still working as hard as ever at age 77: "What should I do all day? Play shuffleboard?") But his real talent is as a mimic. He does dead-on imitations of everyone from the Kansas oil tycoon who tried to give him the boot in his early days as an options dealer ("Cahhhl, I love yah, but I gotta leave yah--mah cousin's in this business now") to the aristocrat whom Icahn helped unload a block of Texaco shares when his cash was tight ("So I say, 'Sir Robert, I hear you got some problems,' and he says, 'Quite correct, quite correct,'" Icahn mimics with a perfect lockjaw) to the trophy wife who complains about people on welfare while entertaining at her Hamptons megamansion to his own mother. When I ask him to do Apple CEO Tim Cook, though, he declines. "Nah, I can't do Cook. I can only do crazies."

Of course, some people say Cook is crazy to listen to Icahn, who has been trying to persuade him since August to give some of Apple's $147 billion cash hoard back to investors in the form of a massive share buyback. Now Icahn is ratcheting up the pressure: he tells TIME that he filed a precatory proposal with Apple on Nov. 26, three days before the deadline for measures to be voted on at the company's next annual shareholders meeting. His proposal, which calls for a stock buyback, would not be binding on the company's management, and that's typical for shareholder resolutions. But it is sure to be spellbinding to financial markets: a buyback would almost certainly push up the price of Apple's stock--and increase the value of Icahn's $2 billion in Apple holdings along with those of all the other Apple investors.

Icahn says he doesn't consider his proposal an indictment of Cook, who has been at Apple's helm since Steve Jobs died in 2011. "Tim Cook is doing a good job with the business," Icahn tells Time. "I think he's good at running the business whether he does what I want or not. But Apple is not a bank."

Either way, Icahn's proposal marks a new stage in the clash between one of the world's most valuable and successful companies and its most formidable shareholder activist. (Icahn, worth $20.3 billion, just edges out George Soros as the top Wall Streeter on Forbes' list of the richest people in America.) It's a battle to which TIME has had a front-row seat over the past several weeks. As Icahn told me over dinner and a five-hour interview at his apartment--the same dining table where he'd sat with Cook in late September and proposed the buyback plan--nudging the management of a company like Apple is somewhat atypical for him. It's a tactic more often associated with an attempt to restructure a weak firm, but Icahn is adamant that isn't the case here. "I'm not against the management of this company," he says. "They've just got too much money on their balance sheet."

The Barbarians Return