(8 of 8)

Apple hasn't exactly been standing still on buybacks. The company has already conducted a $17 billion bond offering to raise funds for a planned $60 billion share repurchase over three years. (The company decided to borrow the money rather than pay the hefty U.S. taxes required to bring some offshore cash back home.) And major institutional investors have supported the existing plans. "I don't think we need a bigger share buyback," says Anne Simpson, director for corporate governance at Calpers, the country's largest pension fund.

For Icahn, though, it's not enough. In a letter to the company dated Oct. 23 and posted on his new corporate-activism website, ShareholdersSquareTable.com he noted that the company trades at a discount to the S&P 500 index despite the fact that it's a cash cow--Apple will likely generate about $51 billion of free cash next year.

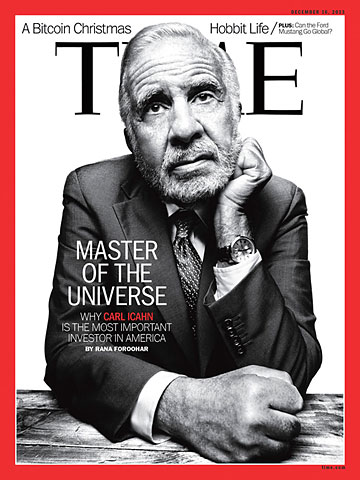

And though he may not have invented the iPhone, Icahn has a pretty impressive track record himself. Anyone who invested in Icahn Enterprises in 2000 and sold at today's price would have gotten a 1,850% return on equity, which comes to an annualized return of 23.8%--compared with 3.6% for the S&P 500. It's a record that's tough to beat--if indeed anyone has done so in that time period. Like many other investment oracles these days, Icahn believes the market is headed down: too much easy money has been propping up earnings for too long, and it can't last forever. That's why, he says, we need people like him to keep goosing corporate executives to do a better job. "This market will break. But I have no idea when ... Nobody can tell you that."