The American Association of Public Accountants is founded in 1887 with 31 members.

It takes an estimated 32.7 hours to complete a standard 1040 income tax form, according to the Internal Revenue Service, so it's no wonder that nearly two-thirds of Americans get professional help. The U.S. income tax code, replete with embellishments like the earned-income tax credit and the mortgage-interest deduction, is not even a century old; the 16th Amendment created the modern federal income-tax structure in 1913. But for years personal-income-tax business for accountants remained a trickle--in 1918, only 5% of Americans earned enough to file returns. After the IRS cracked down on tax evaders in the 1950s, two Missouri brothers smelled opportunity and launched H&R Block, charging customers $5 each to make sure their returns were in order.

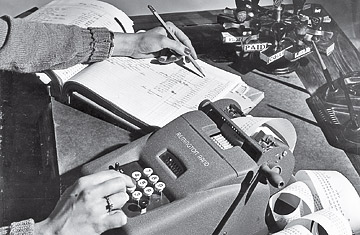

From the 1950s to the 1970s, homeownership and personal incomes grew--and so did tax rates and the increasingly complex tax code. Americans looking to reduce their liabilities turned to experts for advice on how much to donate to charity and what to claim as a business expense. By 1978, H&R Block was responsible for 1 in 9 returns; today the rate is 1 in 7. While many returns are prepared by employees at storefront-shops who take a short training course, there are some 400,000 certified public accountants in the U.S., who have passed a uniform test and are licensed by states.

Despite worries that the current recession may prompt Americans to save on fees and file their own taxes come April 15, more people than ever are going into accounting--some 60,000 now earn accounting degrees annually. The green-eyeshade brigade may even benefit from tax changes in the recent stimulus package. Such updates are always followed by confusion, a boon for tax experts.