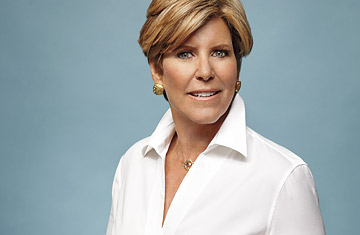

Suze Orman

(3 of 4)

Travis is as responsible as anyone for the power of the Orman brand. In addition to introducing Orman to opera, ballet, foreign travel and fine dining--Orman's favorite meal is crispy Taco Bell tacos--Travis manages Orman's speaking engagements and media appearances. Travis was instrumental in expanding Orman's recognition outside the U.S. and launching her lucrative nonbook products, such as her identity-theft and FICO kits and her contracts with TD Ameritrade and Avon.

"I worked for the best clients in the world. Now I have Suze Orman, who's like my dream come true," said Travis, who is petite, with spiky white hair and twinkly brown eyes. She gazed at Orman across the terrace of their San Francisco home. "All my life, I wanted to have the power of the spotlight. Now I've found my perfect talent."

But for all her success, Orman is no less fallible than some of the economic wizards she criticizes. Her philosophy can be described as prudence and moderation--live within your means is her mantra--but there are elements of her road map that could have put you on the path to serious problems if you had followed them at the wrong time. She has long been fixated on the FICO score, a number that reflects a person's creditworthiness, as the key to improving one's financial situation. The score determines the interest rate people are charged on credit cards, auto loans and mortgages, as well as how much money they can borrow. Almost all of Orman's books include a discussion of how to improve FICO scores to get cheaper credit. Orman now has a business relationship with the Fair Isaac Corp., the company that calculates and sells FICO scores; she plugs the company in her books, while Fair Isaac sells her FICO Kit Platinum on its website for $49.95. (See the top 10 non-fiction books of 2008.)

Home ownership is a cornerstone of Ormanworld, and a good FICO score makes it easier. "A home is flat-out the best big-ticket purchase you will ever make," she wrote in The Money Book for the Young, Fabulous and Broke, which came out in hardcover in 2005 and paperback in 2007. "Just like your student loans, mortgage debt is truly good debt." The book, which is geared toward people in their 20s, suggests that a 3% down payment on a home is acceptable in some circumstances and recommends a hybrid mortgage, which involves a fixed-rate loan that converts to an adjustable-rate one at some future date ("the Goldilocks option"). Under normal circumstances, this might work out fine, but if you had followed that strategy when the book came out, you might have been ruined when the housing market fell apart. (See pictures of Americans in their homes.)

Bill Fleckenstein, a personal-finance columnist and the author of Greenspan's Bubbles, criticizes Orman and others like her for suggesting that "automatic pilot" investing will lead to riches and for not seeing the risks of the stock-market and real estate bubbles. "'No one knew'--that happens to be a lot of B.S. Lots of people knew. It was obvious," Fleckenstein said. "If someone had no understanding of the financial crisis and they completely missed it, then why should you listen to what they say now?"

Orman says she did everything she could have done to help her followers avoid financial calamity. She points to a 2004 CNBC show she did in which she predicted that the stock market would climb for a few years before dropping to 2002 levels. She says her emphasis has always been only on having money in the market that won't be touched for at least 10 years. (Although this isn't a sure thing either, since the past 10-year period in the stock market has been one of the worst-performing in history.) Orman also broadcast later shows on which she said people should be careful with adjustable-rate and interest-only loans and expressed concern about the housing mania.