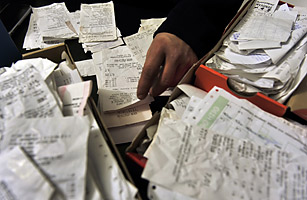

Every year, you swear you'll be better organized, and every year, you still find yourself dashing around the house, digging in drawers for receipts. Why bother? The IRS never asks for receipts anyway, right?

Likely consequence: You should always save your receipts when you claim a deduction, whether it's for business, charity, medical expenses or otherwise. While the IRS does not require you to submit your receipts along with your tax return, the IRS does require you retain your receipts for at least as long as the statute of limitations remains open for your return. That's generally a period of three years from the filing date but can be, under some circumstances, bumped up to six years.

If you fail to produce receipts when asked, your deductions will be disallowed and the IRS may also impose penalties and interest. Last year, the IRS sued Edmund Douglas Roberts after the Californian claimed to have donated $30,000 in 2005. But when the IRS asked Roberts to prove that figure, he had a tough time. Roberts said his charitable giving included money he had given to panhandlers and donations of "more than 450 items of property consisting primarily of used clothing, but also including, among other things, towels, bed sheets, books, costume jewelry, children's toys, and glass lamps." A judge ruled against Roberts and he was assessed for additional taxes of $10,482.75 plus interest and penalties.