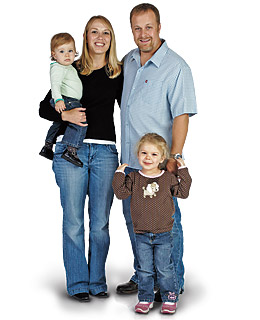

Erik and Lisa Langsdorf

Erik, 33, and Lisa, 29, live in Andover, Minn., with their kids Alaina, 3, and Sadie, 1. Erik, a plumber, was laid off last month. Lisa works for an insurance company.

CURRENT SITUATION:

• When they were both working, the Langsdorfs put 10% of their combined

monthly income toward retirement and set aside 5% in a rainy-day fund.

• When Erik lost his job last month, the couple stopped contributing to

the 529 plans they had set up to help pay for their children's college

education.

• In addition to switching from brand-name groceries to

generics, they have cut back other expenses, from baseball outings to

car trips. Of the market, Lisa says, "It can't get much worse. There was

a lot of greed out there."

WHAT THEY SHOULD DO:

Facing potential consolidation in the insurance industry, Lisa should

plan for the possibility that she too could get laid off, says Chatzky.

She should think about what skills she could draw on. "The best time to

look for a job is when you already have one," Chatzky says.