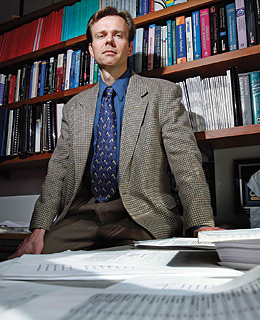

Erik Lie

The old saw "those who can, do; those who can't, teach" has been set on its ear once again, this time by a young Midwestern college professor. Erik Lie (pronounced Lee), 38, an associate professor at the University of Iowa's Henry B. Tippie College of Business, is the Mapquest for the SEC's investigation into options backdating, the practice of revising the date of an option grant so the recipient reaps undeserved rewards. Civil charges have been lodged against many corporations. There are at least five criminal indictments against corporate officers and a number of shareholder lawsuits.

It was Lie's intellectual curiosity that led him to question a pattern in stock-price behavior that was widely accepted as coincidental: Why is it that the issuance of stock options to executives was regularly followed by an increase in the stock's value? He soon figured out that happenstance played no role; timing was everything. Corporations gave out stock options after market value rose but falsified the issue date as an earlier time when the value was lower. Lie's findings, which he delivered to the SEC, reinforce the concept that the successful functioning of our markets depends as much on the resolve of researchers, whistle-blowers and regulators as it does on the work of CEOs. It is immensely important that Lie's chosen path of academia affords him the tools to analyze and assess our economy in a dispassionate, unbiased way. It is even more important that Lie is fostering the curiosity of a new generation of minds and teaching them to puzzle out how the world works.

Spitzer is Governor of New York and was formerly the state's attorney general. He prosecuted numerous corporations after the dotcom bust