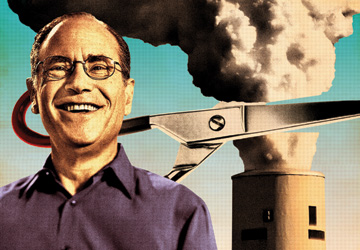

I first met Richard Sandor around 10 years ago when discussions about creating a global carbon market began. He's been enormously important to the development of the emissions-trading industry since its beginnings. As chief economist for the Chicago Board of Trade in the 1970s, he had helped develop the financial futures market, and in the late 1980s and early 1990s he all but invented cap-and-trade programs for sulfur dioxide (SO2) emissions, the pollutant that causes acid rain. The methodology was simple: the government puts a cap on SO2 and then the market takes over, with companies that can economically reduce SO2 on their own allowed to sell emissions rights to those that can't. Doing the same thing with greenhouse emissions was the logical next step, and from the 1992 Earth Summit on, Sandor was at the forefront of those efforts, launching the Chicago and the European Climate Exchanges, where companies could meet to trade carbon.

Sandor is an innovator and a great booster of new markets, and he had the vision to create something out of nothing. He doesn't just work at the level of theory, but encourages others to get involved. And he's always been phenomenal at making money. He realized that if we built enthusiasm in a market for actually valuing the reduction of carbon emissions — and the global carbon market is already worth more than $30 billion — we'd have a chance of solving this problem, and solving it profitably. If we achieve that goal, Sandor will be remembered for decades to come as a genuine pioneer — a man who harnessed the power of financial incentives as a force for change.

James Cameron is vice chairman of Climate Change Capital and chairman of the Carbon Disclosure Project