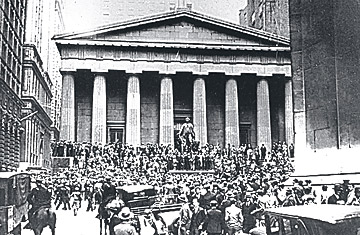

Stocks fell off what Irving Fisher had called a "permanently high plateau" in October 1929 and didn't return until that level until 1954.

Irving Fisher lives on in American economic history mainly as a laughingstock. He was, after all, the ninny who declared on Oct. 15, 1929, that stock prices had reached "what looks like a permanently high plateau." Two weeks later, stocks plunged off that plateau--not to return to their 1929 level for a quarter-century.

There was more to Fisher than those infamous words. The longtime Yale professor was a successful entrepreneur (he devised and marketed a precursor to the Rolodex), the author of a best-selling textbook on personal hygiene, one of the most prominent backers of Prohibition and a leading eugenicist (that...