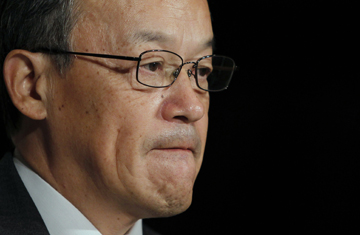

Shuichi Takayama, Olympus' president, speaks at a news conference in Tokyo on Nov. 8, 2011

You've got to feel a little bit sorry for Shuichi Takayama, a lifer at the beleaguered Olympus Corp. who nearly two weeks ago was appointed the new chief executive after his predecessor had fallen on his sword to take "responsibility" for one of the most bewildering corporate scandals in years. Recall that Takayama, in the immediate aftermath of his ascension, had insisted that there was absolutely nothing improper with three bizarre acquisitions Olympus had made from 2006 to '08 — paying more than $1 billion for companies that had no connection to the camera maker's core businesses and, at the time, had no revenue, let alone profits. As for the staggering $687 million "fee" paid to two U.S.-based investment bankers in connection with another acquisition Olympus had made in 2008, that too was all on the up and up.

On Tuesday, the board at Olympus rolled Takayama out before the press again. Bowing deeply — as all Japanese executives apologizing for scandals do — the new CEO this time changed the script. The funds that went to accounts registered in the Cayman Islands in order to pay for the three mystery companies were used, Takayama said, to hide losses — he used the phrase "clean up" in his press conference — on other investments Olympus had made going back more than a decade earlier. He blamed former CEO Tsuyoshi Kikukawa and two other recently dismissed senior corporate officers for the cover-up. The jarring change in the CEO's story sent Olympus' stock down another 14%. It's now down more than 70% since mid-October, when the company's former president, British citizen Michael Woodford, first raised the accounting issues publicly. (He had raised them internally with his boss, Kikukawa, and having been fired for doing so, he went public with them on Oct. 11.)

During Tuesday's press conference, Takayama seemed to suggest that Olympus has engaged in a practice known in Japan as tobashi (to fly away); in the past, brokerage firms in particular have been notorious for setting up dummy accounts for important corporate clients in order to hide investment losses when they occur — shifting the loss from either their or their customers' balance sheets into another account. In 1997, one of the then "big four" Japanese brokerage firms, Yamaichi Securities, collapsed after moving hundreds of billions of yen into tobashi accounts on behalf of 10 different customers.

Takayama's assertion that the three acquisitions had been made in order to "clean up" previous losses on previous investments thus conjured up bad memories for Japan's brokerage firms, the largest of which, Nomura, has a close relationship with Olympus. Nomura's shares plunged in the wake of the Takayama's statement, which prompted the company at the close of business Tuesday to deny bluntly that it had anything to do with whatever it was the Olympus CEO was talking about. "Those reports are based on speculation and not on fact," Nomura said in a written statement.

In truth, Takayama's press conference, far from clarifying matters, only raised more questions — a fact that a further 20% plunge in the company's stock price on Wednesday only highlighted. One issue is basic — and central to the mystery of what happened at Olympus: for all the coverage in the press, both inside Japan and outside, about tobashi, it remains utterly unclear (to put it mildly) as to how transferring funds to finance three relatively recent acquisitions — then writing down the value of those investments, as Olympus did, by 75% — helps "clean up" bad investments made more a decade or more ago.

How, exactly, does that work? Nor did Takayama give any clues as to who exactly received the money paid for those investments. (Olympus had previously said it didn't know who stood behind the numbered accounts in the Cayman Islands into which the funds for the acquisitions were transferred.)

And he wasn't very forthcoming about the gargantuan size of the payment — 30 times the typical fee paid to bankers on M&A deals — given to the two former Nomura investment bankers who worked on Olympus' buy of Gyrus, the British medical-equipment company, in 2008. Today, the Nikkei, Japan's leading financial newspaper, reported that "some of the money" in both the Gyrus payment and the three previous acquisitions "were rerouted to off-balance-sheet funds and used to offset the losses on [Olympus'] securities holdings."

The key phrase in that sentence is some of. Former CEO and whistle-blower Woodford told the Financial Times that a thorough "forensic accounting" is still clearly necessary at Olympus. Meanwhile, FBI and Serious Fraud Office inquiries continue in the U.S. and the U.K., respectively, and various Japanese media reports say law-enforcement authorities in Tokyo may commence their own investigation. Maybe someone will be able to figure out where all the money went — and why.