Corrections Appended: February 26 and March 12, 2013

1. Routine Care, Unforgettable Bills

When Sean Recchi, a 42-year-old from Lancaster, Ohio, was told last March that he had non-Hodgkin's lymphoma, his wife Stephanie knew she had to get him to MD Anderson Cancer Center in Houston. Stephanie's father had been treated there 10 years earlier, and she and her family credited the doctors and nurses at MD Anderson with extending his life by at least eight years.

Because Stephanie and her husband had recently started their own small technology business, they were unable to buy comprehensive health insurance. For $469 a month, or about 20% of their income, they had been able to get only a policy that covered just $2,000 per day of any hospital costs. "We don't take that kind of discount insurance," said the woman at MD Anderson when Stephanie called to make an appointment for Sean.

Stephanie was then told by a billing clerk that the estimated cost of Sean's visit — just to be examined for six days so a treatment plan could be devised — would be $48,900, due in advance. Stephanie got her mother to write her a check. "You do anything you can in a situation like that," she says. The Recchis flew to Houston, leaving Stephanie's mother to care for their two teenage children.

About a week later, Stephanie had to ask her mother for $35,000 more so Sean could begin the treatment the doctors had decided was urgent. His condition had worsened rapidly since he had arrived in Houston. He was "sweating and shaking with chills and pains," Stephanie recalls. "He had a large mass in his chest that was ... growing. He was panicked."

Nonetheless, Sean was held for about 90 minutes in a reception area, she says, because the hospital could not confirm that the check had cleared. Sean was allowed to see the doctor only after he advanced MD Anderson $7,500 from his credit card. The hospital says there was nothing unusual about how Sean was kept waiting. According to MD Anderson communications manager Julie Penne, "Asking for advance payment for services is a common, if unfortunate, situation that confronts hospitals all over the United States."

Claudia Susana for TIME

Sean Recchi Diagnosed with non-Hodgkin's lymphoma at age 42. Total cost, in advance, for Sean's treatment plan and initial doses of chemotherapy: $83,900. Charges for blood and lab tests amounted to more than $15,000; with Medicare, they would have cost a few hundred dollars

Why?

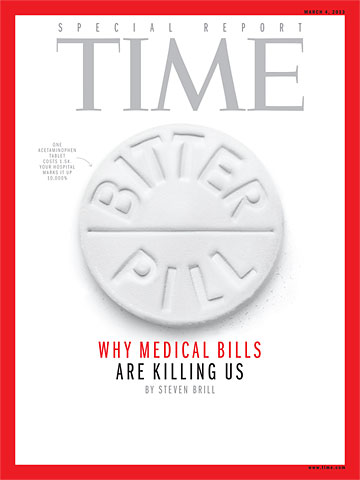

The first of the 344 lines printed out across eight pages of his hospital bill — filled with indecipherable numerical codes and acronyms — seemed innocuous. But it set the tone for all that followed. It read, "1 ACETAMINOPHE TABS 325 MG." The charge was only $1.50, but it was for a generic version of a Tylenol pill. You can buy 100 of them on Amazon for $1.49 even without a hospital's purchasing power.

Dozens of midpriced items were embedded with similarly aggressive markups, like $283.00 for a "CHEST, PA AND LAT 71020." That's a simple chest X-ray, for which MD Anderson is routinely paid $20.44 when it treats a patient on Medicare, the government health care program for the elderly.

Every time a nurse drew blood, a "ROUTINE VENIPUNCTURE" charge of $36.00 appeared, accompanied by charges of $23 to $78 for each of a dozen or more lab analyses performed on the blood sample. In all, the charges for blood and other lab tests done on Recchi amounted to more than $15,000. Had Recchi been old enough for Medicare, MD Anderson would have been paid a few hundred dollars for all those tests. By law, Medicare's payments approximate a hospital's cost of providing a service, including overhead, equipment and salaries.

On the second page of the bill, the markups got bolder. Recchi was charged $13,702 for "1 RITUXIMAB INJ 660 MG." That's an injection of 660 mg of a cancer wonder drug called Rituxan. The average price paid by all hospitals for this dose is about $4,000, but MD Anderson probably gets a volume discount that would make its cost $3,000 to $3,500. That means the nonprofit cancer center's paid-in-advance markup on Recchi's lifesaving shot would be about 400%.

When I asked MD Anderson to comment on the charges on Recchi's bill, the cancer center released a written statement that said in part, "The issues related to health care finance are complex for patients, health care providers, payers and government entities alike ... MD Anderson's clinical billing and collection practices are similar to those of other major hospitals and academic medical centers."

The hospital's hard-nosed approach pays off. Although it is officially a nonprofit unit of the University of Texas, MD Anderson has revenue that exceeds the cost of the world-class care it provides by so much that its operating profit for the fiscal year 2010, the most recent annual report it filed with the U.S. Department of Health and Human Services, was $531 million. That's a profit margin of 26% on revenue of $2.05 billion, an astounding result for such a service-intensive enterprise.1

The president of MD Anderson is paid like someone running a prosperous business. Ronald DePinho's total compensation last year was $1,845,000. That does not count outside earnings derived from a much publicized waiver he received from the university that, according to the Houston Chronicle, allows him to maintain unspecified "financial ties with his three principal pharmaceutical companies."

DePinho's salary is nearly two and a half times the $750,000 paid to Francisco Cigarroa, the chancellor of entire University of Texas system, of which MD Anderson is a part. This pay structure is emblematic of American medical economics and is reflected on campuses across the U.S., where the president of a hospital or hospital system associated with a university — whether it's Texas, Stanford, Duke or Yale — is invariably paid much more than the person in charge of the university.

I got the idea for this article when I was visiting Rice University last year. As I was leaving the campus, which is just outside the central business district of Houston, I noticed a group of glass skyscrapers about a mile away lighting up the evening sky. The scene looked like Dubai. I was looking at the Texas Medical Center, a nearly 1,300-acre, 280-building complex of hospitals and related medical facilities, of which MD Anderson is the lead brand name. Medicine had obviously become a huge business. In fact, of Houston's top 10 employers, five are hospitals, including MD Anderson with 19,000 employees; three, led by ExxonMobil with 14,000 employees, are energy companies. How did that happen, I wondered. Where's all that money coming from? And where is it going? I have spent the past seven months trying to find out by analyzing a variety of bills from hospitals like MD Anderson, doctors, drug companies and every other player in the American health care ecosystem.

When you look behind the bills that Sean Recchi and other patients receive, you see nothing rational — no rhyme or reason — about the costs they faced in a marketplace they enter through no choice of their own. The only constant is the sticker shock for the patients who are asked to pay.

Photograph by Nick Veasey for TIME

Gauze Pads: $77 Charge for each of four boxes of sterile gauze pads, as itemized in a $348,000 bill following a patient's diagnosis of lung cancer

Yet those who work in the health care industry and those who argue over health care policy seem inured to the shock. When we debate health care policy, we seem to jump right to the issue of who should pay the bills, blowing past what should be the first question: Why exactly are the bills so high?

What are the reasons, good or bad, that cancer means a half-million- or million-dollar tab? Why should a trip to the emergency room for chest pains that turn out to be indigestion bring a bill that can exceed the cost of a semester of college? What makes a single dose of even the most wonderful wonder drug cost thousands of dollars? Why does simple lab work done during a few days in a hospital cost more than a car? And what is so different about the medical ecosystem that causes technology advances to drive bills up instead of down?

Recchi's bill and six others examined line by line for this article offer a closeup window into what happens when powerless buyers — whether they are people like Recchi or big health-insurance companies — meet sellers in what is the ultimate seller's market.

The result is a uniquely American gold rush for those who provide everything from wonder drugs to canes to high-tech implants to CT scans to hospital bill-coding and collection services. In hundreds of small and midsize cities across the country — from Stamford, Conn., to Marlton, N.J., to Oklahoma City — the American health care market has transformed tax-exempt "nonprofit" hospitals into the towns' most profitable businesses and largest employers, often presided over by the regions' most richly compensated executives. And in our largest cities, the system offers lavish paychecks even to midlevel hospital managers, like the 14 administrators at New York City's Memorial Sloan-Kettering Cancer Center who are paid over $500,000 a year, including six who make over $1 million.

Taken as a whole, these powerful institutions and the bills they churn out dominate the nation's economy and put demands on taxpayers to a degree unequaled anywhere else on earth. In the U.S., people spend almost 20% of the gross domestic product on health care, compared with about half that in most developed countries. Yet in every measurable way, the results our health care system produces are no better and often worse than the outcomes in those countries.

According to one of a series of exhaustive studies done by the McKinsey & Co. consulting firm, we spend more on health care than the next 10 biggest spenders combined: Japan, Germany, France, China, the U.K., Italy, Canada, Brazil, Spain and Australia. We may be shocked at the $60 billion price tag for cleaning up after Hurricane Sandy. We spent almost that much last week on health care. We spend more every year on artificial knees and hips than what Hollywood collects at the box office. We spend two or three times that much on durable medical devices like canes and wheelchairs, in part because a heavily lobbied Congress forces Medicare to pay 25% to 75% more for this equipment than it would cost at Walmart.

The Bureau of Labor Statistics projects that 10 of the 20 occupations that will grow the fastest in the U.S. by 2020 are related to health care. America's largest city may be commonly thought of as the world's financial-services capital, but of New York's 18 largest private employers, eight are hospitals and four are banks. Employing all those people in the cause of curing the sick is, of course, not anything to be ashamed of. But the drag on our overall economy that comes with taxpayers, employers and consumers spending so much more than is spent in any other country for the same product is unsustainable. Health care is eating away at our economy and our treasury.

The health care industry seems to have the will and the means to keep it that way. According to the Center for Responsive Politics, the pharmaceutical and health-care-product industries, combined with organizations representing doctors, hospitals, nursing homes, health services and HMOs, have spent $5.36 billion since 1998 on lobbying in Washington. That dwarfs the $1.53 billion spent by the defense and aerospace industries and the $1.3 billion spent by oil and gas interests over the same period. That's right: the health-care-industrial complex spends more than three times what the military-industrial complex spends in Washington.

When you crunch data compiled by McKinsey and other researchers, the big picture looks like this: We're likely to spend $2.8 trillion this year on health care. That $2.8 trillion is likely to be $750 billion, or 27%, more than we would spend if we spent the same per capita as other developed countries, even after adjusting for the relatively high per capita income in the U.S. vs. those other countries. Of the total $2.8 trillion that will be spent on health care, about $800 billion will be paid by the federal government through the Medicare insurance program for the disabled and those 65 and older and the Medicaid program, which provides care for the poor. That $800 billion, which keeps rising far faster than inflation and the gross domestic product, is what's driving the federal deficit. The other $2 trillion will be paid mostly by private health-insurance companies and individuals who have no insurance or who will pay some portion of the bills covered by their insurance. This is what's increasingly burdening businesses that pay for their employees' health insurance and forcing individuals to pay so much in out-of-pocket expenses.

1. Here and elsewhere I define operating profit as the hospital's excess of revenue over expenses, plus the amount it lists on its tax return for depreciation of assets — because depreciation is an accounting expense, not a cash expense. John Gunn, chief operating officer of Memorial Sloan-Kettering Cancer Center, calls this the "fairest way" of judging a hospital's financial performance

The original version of this article misidentified William Powers Jr., the president of the University of Texas system, as the head of the entire system. That is in fact Francisco Cigarroa, the chancellor of the University of Texas