(2 of 11)

In fact, Romney will soon shift Bain's focus away from venture capital, looking for surer bets. The firm will concentrate on private equity, a new term for the old leveraged-buyout business that became notorious for excesses in the Reagan era. It works like this: Romney will search out struggling companies and borrow most of the money to buy them, using a company's own assets as collateral. That is roughly like buying a farm with a mortgage that the farmer has to repay. As the new owner, Bain Capital will demand that the company squeeze costs, close money-losing divisions and shift resources to more profitable lines of business. Sometimes--more often than its peers--Bain Capital will buy a company and stay with it for years, improving management and restoring it to health. Other times it will shutter factories, lay off workers and leave a company loaded with debts it cannot pay. In either case, Romney's firm will boost its own profit or cushion its risk by charging the company special dividends for its services and by structuring the deal to take advantage of tax and regulatory rules. These transaction features, known as tax arbitrage, can easily reap enough profit to let Romney come out ahead even if a company fails.

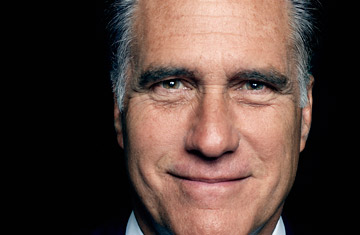

The record of Romney's 15 years as leader of Bain Capital depicts a businessman of exceptional talent--and exceptional caution. In his formative years as a financier, he worked relentlessly to squeeze risk out of an enterprise in which risk and profit typically went hand in hand. He imposed on his partners a rigorous focus on measurable, verifiable data, rejecting subjective judgments about business prospects and insisting on empirical evidence on which to base decisions.

Romney's appetite for numbers far surpassed the norm. Even as chief executive of Bain, he spent hours at the conference table, taking copious notes, tapping at his calculator and making hand-drawn charts. He was slower than many competitors to seize opportunity, searching for hidden flaws in every deal. He sought out rival views and seldom if ever invested without consensus from his partners. Bain Capital taught him to regard the world as an endless parade of potential deals, most of them bad. He walked away from nearly all of them, needing only a few for success. As often as possible, he declined to join any game he did not think he would win. But certainty is not the word for what Romney likes most, says former consulting partner James McCurry, now president and CEO of PSA Healthcare. "He wants to be right," McCurry says. "He wants to be--you never get to be sure, that doesn't exist in life, but he wants to be right."

A MAN AND HIS CALCULATOR