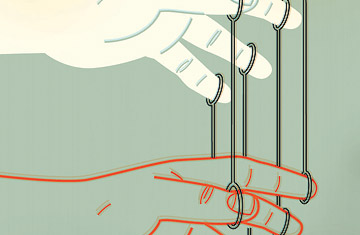

You know Adam Smith for his "invisible hand," the mysterious force that steers the selfish economic decisions of individuals toward a result that leaves us all better off. It's been a hugely influential idea, one that during the last few decades of the 20th century began to take on the trappings of a universal truth.

Lately, though, the invisible hand has been getting slapped. The selfish economic decisions of home buyers, mortgage brokers, investment bankers and institutional investors over the past decade clearly did not leave us all better off. Did Smith have it wrong?

No, Smith did not have it wrong. It's just that some of his self-proclaimed disciples have given us a terribly incomplete picture of what he believed. The man himself used the phrase invisible hand only three times: once in the famous passage from The Wealth of Nations that everybody cites; once in his other big book, The Theory of Moral Sentiments; and once in a posthumously published history of astronomy (in which he was talking about "the invisible hand of Jupiter" — the god, not the planet). For Smith, the invisible hand was but one of an array of interesting social and economic forces worth thinking about.

Why did the invisible hand emerge as the one idea from Smith's work that everybody remembers? Mainly because it's so simple and powerful. If the invisible hand of the market really can be relied on at all times and in all places to deliver the most prosperous and just society possible, then we'd be idiots not to get out of the way and let it work its magic. Plus, the supply-meets-demand straightforwardness of the invisible-hand metaphor lends itself to mathematical treatment, and math is the language in which economists communicate with one another.

Hardly anything else in Smith's work is nearly that simple or consistent. Consider The Theory of Moral Sentiments, his long-neglected other masterpiece, published 17 years before The Wealth of Nations, in 1759. I recently cracked open a new 250th-anniversary edition, complete with a lucid introduction by economist Amartya Sen, in hopes that it would make clearer how we ought to organize our economy.

Fat chance. Most of the book is an account of how we decide whether behavior is good or not. In Smith's telling, the most important factor is our sympathy for one another. "To restrain our selfish, and to indulge our benevolent affections, constitutes the perfection of human nature," he writes. But he goes on to say that "the commands and laws of the Deity" (he seems to be referring to the Ten Commandments) are crucial guides to conduct too. Then, in what seems to be a strange detour from those earthly and divine parameters, he argues that the invisible hand ensures that the selfish and sometimes profligate spending habits of the rich tend to promote the public good.

There are similar whiplash moments in The Wealth of Nations. The dominant theme running through the book is that self-interest and free, competitive markets can be powerful forces for prosperity and for good. But Smith also calls for regulation of interest rates and laws to protect workers from their employers. He argues that the corporation, the dominant form of economic organization in today's world, is an abomination.

The point here isn't that Smith was right in every last one of his prescriptions and proscriptions. He was an 18th century Scottish scholar, not an all-knowing being. Many of his apparent self-contradictions are just that — contradictions that don't make a lot of sense.

But Smith was also onto something that many free-market fans who pledge allegiance to him miss. The world is a complicated place. Markets don't exist free of societies and governments and regulators and customs and moral sentiments; they are entwined. Also, while markets often deliver wondrous results, an outcome is not by definition good simply because the market delivers it. Some other standards have to be engaged.

Applying Smith's teachings to the modern world, then, is a much more complex and doubtful endeavor than it's usually made out to be. He certainly wouldn't have been opposed to every government intervention in the market. On financial reform, it's easy to imagine Smith supporting the creation of a Consumer Financial Protection Agency and crackdowns on giant financial institutions. He might have also favored the just-passed health care reform bill, at least the part that requires states to set up exchanges to ensure retail competition for health insurance.

Then again, he might not have. Asking "What would Adam Smith say?" is a lot easier than conclusively answering it. It is pretty clear, though, that he wouldn't just shout, "Don't interfere with the invisible hand!" and leave it at that.

Fox is the editorial director of the Harvard Business Review Group