In the past, government and business leaders gathering for meetings of the Asia-Pacific Economic Cooperation (APEC) forum had to resort to collective fashion blunders to demonstrate unity. Representatives of this diverse group of 21 Asia-Pacific nations, who together represent roughly 40% of the world's population and 54% of the world's GDP, have bravely donned the traditional dress of the host country, from cowboy hats to ponchos to garishly colored batik shirts, to show that despite their differences, everybody could be made to look a bit ridiculous for a group photo op.

This year, outlandish costumes won't be necessary to unite the group when they meet Nov. 12-13 in Singapore. The global financial crisis has already done it for them. As Asia searches for a new growth engine to replace the economically sputtering U.S., and as the U.S. looks increasingly to Asia for consumers to sell to and governments to borrow from, the question hovering over the summit is, Can the leaders of the world's fastest-growing region find a new economic model that works for both East and West?

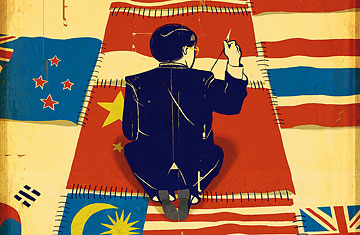

The anxiety over APEC's economic future has rejuvenated an idea once dismissed as unwieldy and unrealistic: the knitting together of a free-trade zone, similar to the European Union, straddling the Asia-Pacific region. Proposed by APEC's Business Advisory Council, this zone would include most of Asia (but not India) and a sliver of Central and South America, as well as big non-Asian economies like the U.S., Russia and Canada. If all of APEC's member countries participated — a big if — its combined annual GDP would be $37 trillion, 21/2 times that of the E.U., the world's largest economic bloc in terms of combined output, according to the International Monetary Fund.

The concept of linking some of the world's fastest-growing economies isn't new. Various versions of an Asian free-trade zone have been mooted in the past. But with Asian economies leading the world out of recession while America languishes, the topic is coming up with increasing frequency. At a meeting of regional leaders hosted by the Association of Southeast Asian Nations in Thailand last month, Japan's Prime Minister Yukio Hatoyama proposed an "East Asian community" that would bind together Japan, China, South Korea and the 10 countries of Southeast Asia, plus India, Australia and New Zealand. Hatoyama — who recently opined that "the era of U.S.-led globalism is coming to an end" — suggested this zone have its own common currency and could some day "lead the world." Less ambitiously, China has suggested a smaller group that would include Southeast Asia plus Japan, China and South Korea.

The logic for closer Asian economic integration is becoming more compelling as intraregional trade becomes more important when compared with Asia's trade with the West. According to HSBC, the share of Asia's exports to the U.S. and Europe declined to 30% of the regional total in 2008, down from nearly 40% in 1998. Over the same period, intraregional exports as a share of total exports in emerging Asia rose to 54% from 46%. "Intra-Asian trade flows are the fastest growing in the world," says Lawrence Webb, global head of trade and supply chain at HSBC. This trend has accelerated since the financial crisis. HSBC predicts that trade among Asian countries will grow at an annual average rate of 12.2% until 2020. The region's trade with the U.S. is projected to grow 7.3% annually over the same period.

This marks a big change. As Thailand's Prime Minister Abhisit Vejjajiva said during the recent ASEAN summit, "The old growth model where, simply put, we have still to rely on consumption in the West for goods and services produced here, we feel will no longer serve us." This is especially true because China, which is poised to overtake Japan as the world's second largest economy, is an increasingly important trading partner for countries such as Japan, South Korea and Indonesia. "Asian firms would do better to reorient their exports and production towards meeting the demand of Chinese consumers," says Kit Wei Zheng, a Singapore-based economist with Citigroup. "Firms that refuse to change strategy to cater to Chinese demand will sooner or later find themselves overtaken by competitors and abandoned by investors."

An Asian free-trade zone would aid economic growth by cutting import duties and eliminating the murky morass of trade barriers that impedes commerce. A model to emulate would be the establishment of the E.U., which made it far easier for companies to import and export their goods within Europe, says HSBC's Webb. Establishing a common Asian currency similar to the euro would allow companies to ship goods or arrange credit with less exposure to currency risk. "A barrier to trade over the last year in Asia has been fluctuating currencies," Webb says. "For a small- to medium-sized business, it could mean the difference between profit and loss."

The chatter of the formation of an Asian trading bloc could make things awkward for U.S. President Barack Obama during his scheduled appearance at APEC in Singapore. But some American businessmen support the idea — as long as the U.S. is included. Creating a common set of trade rules would simplify the bewildering spaghetti bowl of bilateral trade agreements that have been signed between various Asian countries in recent years, executives say. Others, worried about their prospects in a China-led free-trade zone, are eager to see APEC take the lead. Says Kevin Thieneman, the Southeast Asia and India country manager for industrial-equipment giant Caterpillar: "There must be a realization by the Obama Administration that the U.S. is getting lapped when it comes to trade in Asia. There is a lack of understanding in the U.S. about how fast the bilateral trade agreements are happening out here."

Realistically, it could take many years to form an E.U.-style trading bloc in the region — if such a body can be formed at all. Historical enmities simmering between nations like China and Japan could make close cooperation impossible, as could divergent economic interests of poor developing countries like Vietnam and those of advancing industrial economies like South Korea. Another commonly cited impediment is cultural diversity. "Europe is in a sense a single civilization; Asia is not," says Ravi Menon, Permanent Secretary of Singapore's Ministry of Trade and Industry. Others question whether Asia's institutions are robust enough for an E.U.-style union. "Are political institutions mature enough in Asia to do what Europe did?" asks Cem Karacadag, a Singapore-based economist with Credit Suisse.

There are other reasons Asia may not be ready. One of the central goals of an Asian bloc would be to make it easier for China to buy a greater proportion of the region's output as the U.S. fades as an engine of global consumption and growth. But, while China's per capita GDP now stands at about $3,200, up nearly fourfold since 1997, it's still a far cry from U.S. per capita GDP of about $46,000. Moreover, conservative Chinese financial habits are deeply ingrained and driven by the need for "precautionary savings" for medical care, old age or sudden calamity in the absence of robust government safety nets. "It's not that Chinese like to save for the sake of savings," says Tan Khee Giap, chair of the Singapore chapter of the Pacific Economic Cooperation Council. "It's that for thousands of years they had to save to protect themselves." In other words, making it easier for other Asian countries to access China's market isn't the same as convincing Chinese consumers to spend more. "The Chinese remind everyone it will take a long time," says Menon of Singapore's Ministry of Trade and Industry. According to Citigroup, China will indeed become the world's largest retail market — by 2030. That's a lengthy wait for some of benefits of an Asian trading bloc to accrue.

Still, pressure for reductions in regional trade barriers is building, partly due to frustration over the failure of the World Trade Organization to complete the Doha Development Round, which is supposed to lower trade barriers globally. Leaders at the upcoming APEC summit are expected to commit to the completion of a basic framework for an Asia-Pacific zone by the end of 2010. While the details have yet to be hammered out, such an agreement would be an unprecedented step forward. One thing is for certain: this year's APEC must generate more than an amusing photo.