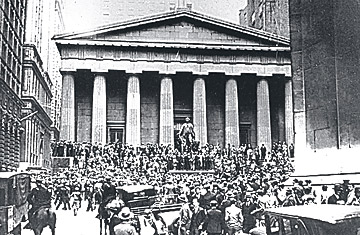

Stocks fell off what Irving Fisher had called a "permanently high plateau" in October 1929 and didn't return until that level until 1954.

(4 of 4)

The issue isn't whether financial markets are useful--they are--or whether the prices of stocks or bonds or collateralized debt obligations convey information--they do. There's also much to be said for the insight at the heart of efficient-market theory: markets are hard to outsmart. But when we give up second-guessing the market, we suspend our judgment. And without participants' exercising judgment--applying research, heeding a broker's opinion--markets stand no chance of ever getting prices right.

Based on Fox's book The Myth of the Rational Market, published this month by HarperBusiness