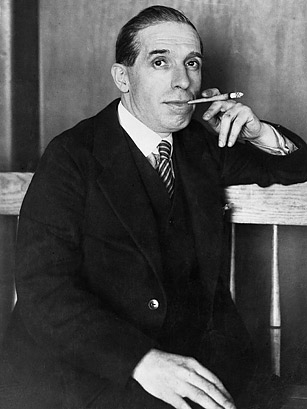

Although he did not invent the scheme that later came to bear his name, Charles Ponzi's scam was so extensive and initially lucrative that it brought national attention to the fraudulent operation for the first time. In 1919, the Italian immigrant promised investors they could yield considerable profits by purchasing international reply coupons from other countries and then redeeming them in the U.S for postage stamps. To legitimize the scheme, Ponzi established the "Securities Exchange Company" based in Boston. A steady flow of new clients allowed him to pay existing investors, while pocketing millions of dollars himself. But soon enough, the scheme began to raise eyebrows, eventually collapsing and bringing six banks down with it. Collectively, his investors lost an estimated $20 million.