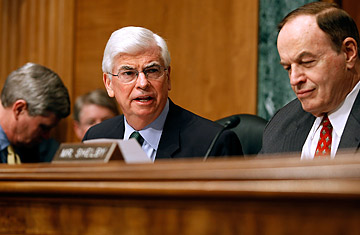

Senate Banking, Housing and Urban Affairs Committee chairman Chris Dodd

What reform could dramatically remake America and become law by Christmas? Not health care. While a health care bill crawls through the Senate, bills of equal significance are speeding through the Banking and Finance committees of both chambers of Congress and will share the spotlight this week on Capitol Hill. And because of the odd politics of finance, and an aggressive behind-the-scenes push by the Obama Administration, real financial reforms have a better chance of becoming law by the end of the year than an overhaul of health care.

That doesn't mean the process is any less messy. There are three versions of financial reform in play. The Administration unveiled its plan in mid-June. Barney Frank, chairman of the House Financial Services Committee, will bring his recently unveiled version to markup in committee as early as this week. Frank and the Administration, represented by Treasury Secretary Timothy Geithner, spent weeks in negotiation, and Frank's bill closely tracks the Administration proposal.

Chris Dodd, chairman of the Senate Banking Committee, will unveil the third version of financial reform as early as Tuesday. Dodd, who faces a tough re-election battle in Connecticut in 2010, told his staff that the proposal put forward by the Administration didn't take into account the possibilities opened up by the enormous financial crisis of the past year. For political or policy reasons — or both — his bill is more aggressive on federal-oversight authority on a number of potentially controversial issues. "We should push for the biggest changes we can get," says Dodd spokeswoman Kirstin Brost.

Dodd would like to gut bank regulators like the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency (OCC), the Federal Reserve and the Office of Thrift Supervision (OTS). He would give their power to supervise and regulate banks to a new, single bank regulator with power to set capital requirements and ensure stability. By contrast, the Frank-Geithner-negotiated bill in the House would do away with only the OTS, leaving the FDIC in charge of state-chartered-bank supervision, the OCC in charge of nationally chartered banks and the Fed in charge of complex financial institutions.

The Dodd proposal would likewise strip the existing regulators of their consumer-watchdog role, putting that authority in a new, separate body, the Consumer Financial Protection Agency (CFPA). In this Dodd, Frank and Geithner agree that a single agency should not be responsible for both ensuring bank stability (read: profitability) and protecting consumers. The CFPA would have rule-making, supervisory and enforcement authority to hunt abuses in lending and fee-setting. The FDIC would continue to exist as an insurer of deposits, while the Fed would continue to control monetary policy and oversee national financial stability.

All three reform packages aim to create a systemic-risk council that can impose emergency measures and unleash extra powers throughout government in case of a future meltdown like the one that almost destroyed the global economy last fall. Dodd differs with the Administration in who should head the council: he wants the President to appoint someone, while the Administration thinks it should be an internal player like the Treasury Secretary.

As for the worst-case scenario, Dodd wants the SEC and FDIC to continue to have the power to dissolve failed banks, while the Administration would give power over big banks to the Federal Reserve. Dodd will also unveil new rules for over-the-counter-derivatives trading, whereas Frank has put off dealing with derivatives reform until next year.

For all the differences, the White House is sanguine about the content of Dodd's bill. "[Dodd] may be right that a tough, strong bill is the easiest to get through with Dems," says an Administration official.

The key remaining player is Alabama's Richard Shelby, the ranking Republican on the Senate Banking Committee, who has been in talks with Dodd for months. His office opposes the CFPA, likes the Dodd provisions that strip the Fed of authority, and backs a single regulator. But Shelby, like everyone else who pays attention to rules controlling the world's largest financial system, is waiting to see the details of Dodd's bill — which no one has yet — before he weighs in officially.