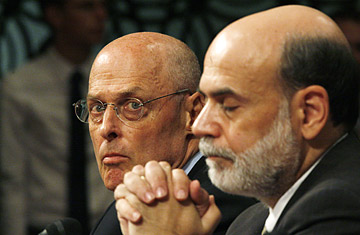

Treasury Secretary Henry Paulson, left, and Federal Reserve Chairman Ben Bernanke are seated at the witness table on Capitol Hill during a Senate Banking Committee hearing

The proposed $700 billion bailout of the nation's beleaguered financial markets has become a taffy pull between the Bush Administration and lawmakers from both parties. Many on Capitol Hill believe Treasury Secretary Henry Paulson is seeking too much unregulated cash and power in his effort to stabilize the economy by buying up toxic mortgage-backed securities. He's also asking Congress to lift the ceiling on the national debt to a record $11.3 trillion from the current $10.6 trillion, which could weaken the U.S. dollar, raise interest rates and act as an additional drag on the economy. All that money has led to lots of questions from lawmakers and taxpayers alike. Here are a few answers.

1. Will it really cost $700 billion?

The dollar estimate of this bailout is just that — an estimate. Think of

it as that bubble that slides up or down inside a level: it keeps moving,

and where it ends up depends on who's talking. Some optimists think the

mortgages the Treasury will buy are basically sound, and that the ultimate

loss to the government after it sells them could be as little as $100

billion. Others point to a drop in housing prices of nearly 20% since

mid-2006 and say the government's eventual loss could approach $1 trillion.

By seeking $700 billion — roughly akin to the cost of the Iraq war (so far)

— the Treasury is taking a middle path. But many on Capitol Hill are pushing a proposal to commit an initial sum of $150 billion to $200 billion before handing over the whole sum.

2. How long will the money last?

The Bush Administration is proposing that the government's mortgage purchases be spread out over two years — while speed is of the essence, the Treasury

needs time to set up a fair program to evaluate just what it's buying.

There is a lot of paperwork to go through: about 10% of the nation's

$11 trillion in mortgages are delinquent or in foreclosure. Uncle Sam would

likely hang on to some of the mortgage securities it buys for far longer

before reselling them to investors, in an attempt to minimize its losses and

maybe even turn a profit.

3. Is this kind of bailout unprecedented?

The current financial Hail Mary is much different from Washington's late

1980s rescue of the nation's savings and loans institutions. This time, the

Federal Government wants only to carve out and buy poorly performing

mortgages and securities, not the institutions that issued them, which had already gone under (or were on their way) when the Resolution Trust Corporation took them over. Richard

Kogan, a federal budget expert at the nonprofit Center for Budget and Policy

Priorities, says that buying all those bad assets creates "the greatest

possibility of giving the taxpayers a bath." But it also makes for quick and

easy implementation. "When you go to a financial institution and say, 'We'd

like to buy your bad assets,' they're going to say, 'Let's sit down and talk

right this minute.' " Some on Capitol Hill, including Representative Barney Frank, the

Massachusetts Democrat who heads the House Financial Services Committee,

think the deal is too sweet for Wall Street and are pushing to give

taxpayers a piece of equity in the companies they would bail out.

4. How will the Federal Government know what price to pay for the

mortgages it buys?

It won't. Even on Wall Street, no one knows how much the mortgage securities are worth. The

government will hire experts to determine their value, but because so many

are "sliced and diced" concoctions — made up of pieces of literally thousands

of mortgages created and peddled and pushed together by Wall Street — the

soundness of the underlying loans will prove difficult to ascertain. Many members of Congress want to make sure the government pays fire-sale prices for the assets to protect taxpayers from a big loss, but Federal Reserve Chairman Ben Bernanke has said that too low a price could hamper the plan's effectiveness at stabilizing the markets.

5. What happens if the cost tops $700 billion?

If more money is required, additional legislation would

have to be approved. The odds of that happening depend on whether or not the

bailout stabilizes the housing market — the better the U.S. economy, the

smaller the bailout will cost taxpayers. And it also depends on how the final bill is worded — the initial draft included ambiguous language that some observers have argued gives the Treasury power to spend more than $700 billion, as long as it isn't holding assets worth more than that at any one point in time.

6. Will all of the federal wheeling and dealing come with transparency and oversight?

Maybe. The bailout is being undertaken by the U.S. Treasury, which means it

can't be hidden away or done "off the books" in an effort to minimize its

apparent scope. The Treasury will consult with experts to figure out

"mechanisms for buying assets and from whom to buy," Paulson said Tuesday.

"We do not know exactly what the best design is." But it's leaning toward

conducting "reverse auctions" in which the Treasury would, for example, buy $1

billion in bad mortgages from whichever

institution would take the least amount of money for them. On the other hand, the Treasury initially asked for a virtual blank check in how it would conduct the bailout, including guarantees that no court or other monitors could second-guess their actions. That provision, not surprisingly, has became a major bone of contention in Congress, and it now appears increasingly likely that some form of oversight will be written into the legislation.

7. Do the Wall Street executives get to keep their bonuses?

The Bush Administration says it needs to encourage executives to get

their cooperation, and that clamping down on their pay would only hurt their

willingness to get on board. Critics in both parties say the threat of the

executives' firms going belly-up should ensure their cooperation regardless

of what restrictions are placed on their once golden parachutes. Mounting

pressure from constituents on Main Street is likely to mean there will be

some cap on compensation associated with the bailout. But corporate America usually finds a way around such limitations, and there are even legal questions about what kind of restrictions can be placed on the firms' compensation structures.