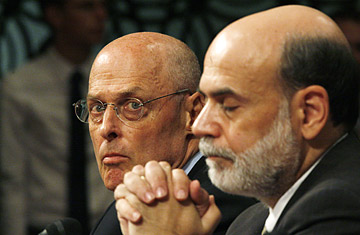

Treasury Secretary Henry Paulson, left, and Federal Reserve Chairman Ben Bernanke are seated at the witness table on Capitol Hill during a Senate Banking Committee hearing

"Give a Democrat a pen ...," grumbled one Republican Senate staffer Monday as he compared Treasury Secretary Henry Paulson and Federal Reserve Chairman Ben Bernanke's three-page plan to rescue the American financial system to the 40-plus-page proposal they got in response from the Democrats. And by that page ratio alone, it might look to the untrained eye as if Paulson's bailout package was headed for failure, an outcome that spooked markets to another day of stomach-churning 4% and 5% drops on Monday.

Tuesday's Senate Banking Committee hearing on the bailout may not reassure anyone. Paulson argued that the Bush Administration's plan is "the single most effective thing we can do to help homeowners, the American people, and stimulate our economy." And he stressed that despite fears on Capitol Hill, he does believe there should be some oversight of the unprecedented bailout. But Democrat Chris Dodd of Connecticut declared, "It is not just our economy at risk but our Constitution as well," while ranking minority member Richard Shelby of Alabama, a vocal critic of the plan, said, "I have long opposed government bailouts for individuals and corporate America alike ... We have been given no credible assurances that this plan will work."

Shelby is likely to oppose the plan, but much of its scrutiny on Capitol Hill is, in fact, Congress doing what Congress does, albeit on a massive, once-in-a-lifetime scale. On any given day on the Hill well-heeled lobbyists graft slivers of language onto obscure bills, language that ends up being worth huge amounts to their clients. This week the U.S. financial system is going to be reordered on a scale unseen since F.D.R., and everyone has an interest in that, sometimes to the tune of hundreds of billions of dollars. In the massive bazaar of legislative trading that is the U.S. Congress, America's elected Representatives are out to get what they can for their most important constituents — be it an equity stake in the companies that the government helps, more aid for struggling homeowners or new limits for executive compensation on Wall Street, all add-ons that many Democrats are pushing.

Paulson knows this as well as anyone. He and his team had been working on his proposal for more than six months, in the event that more piecemeal approaches like the bailout of Bear Stearns or the takeover of Fannie Mae and Freddie Mac didn't stop the bleeding. When things looked like they were headed for a crisis at the beginning of last week, he had a team up literally all night working with the Federal Reserve to frame a deliberately vague proposal that could make it through Congress. The key issue was to get something that could pass, and quickly, as failure would produce a panic that would be unstoppable. What they came up with was the broad, three-page plan giving the Treasury $700 billion to buy back Wall Street's toxic mortgage-backed assets and eventually repackage and sell them.