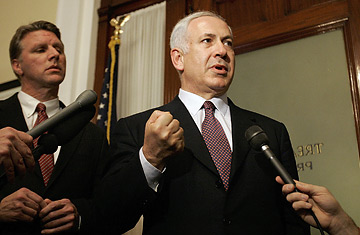

Former Israeli Prime Minister Benjamin Netanyahu, right, speaks to a reporter after a meeting with Massachusetts Treasurer Tim Cahill, left, at Cahill's office at the Statehouse in Boston, January 23, 2007. Netanyahu met with state officials from across New England on Tuesday to urge them to consider economic sanctions against Iran.

(2 of 2)

At the same time, the U.S. government has also recently stepped up cooperation with Saudi Arabia, the world's top petroleum producer, to keep the price of oil at around $50 a barrel — nearly one-third below last year's peak — a price level partly intended to help cut the oil bill for American consumers, but also to reduce Iran's petroleum revenues, which last year hit some $44 billion. More broadly, U.S. sanctions have long prevented American companies from dealing with Iran, but recently U.S. officials have been urging European and Asian banks to avoid involvement with Iran as well; the Treasury has also placed serveral large Iranian banks on U.S. watch lists of institutions suspected of supporting terrorism.

On top of that, previous measures to penalize foreign companies that make sizable investments in Iran's giant oil and gas sector, like the 1995 Iran-Libya Sanctions Act, remain in force. The measure calls for U.S. sanctions on foreign companies that invest more than $20 million a year in Iran's energy sector, and last week Royal Dutch Shell admitted that could put in jeopardy its projected $10 billion investment in an Iranian gas field in cooperation with Spain's Repsol. Shell Chief Executive Jeroen van der Veer said, "I would like to emphasize that we have here quite a dilemma. This is Iran. They are the number two in oil and gas reserves in the world.... But we have all the short-term political concerns."

In spite of such concerns, Iran says it has managed to attract more than $10 billion in foreign cash since U.S. sanctions were enacted. Perhaps for that reason, Tehran officials insist international pressure makes little difference to them — or to the European governments and companies that are resisting it. "There's a great amount of interest [in investing], " National Iranian Oil Company Director Gholam Hossein Nozari told a recent industry conference in Vienna. Iran's state-owned oil company, which controls the world's second-largest oil and natural-gas reserves, is auctioning 17 oil blocks that could attract nearly $600 million in foreign investment. Norway's Statoil ASA, Russia's OAO Lukoil Austria's OMV AG, and Spain's Repsol SA were involved in the two-day conference in Vienna, where the tenders are being presented. According to Nozari, Iran needs about $94 billion of foreign investment by 2014 to bolster oil and gas production, especially because its current output is dropping by some 7% every year due to depletion and lack of upkeep at major fields.