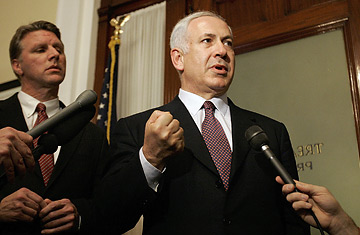

Former Israeli Prime Minister Benjamin Netanyahu, right, speaks to a reporter after a meeting with Massachusetts Treasurer Tim Cahill, left, at Cahill's office at the Statehouse in Boston, January 23, 2007. Netanyahu met with state officials from across New England on Tuesday to urge them to consider economic sanctions against Iran.

As part of this escalating war by other means, former Israeli prime minister Benjamin Netanyahu recently visited the U.S. and met with representatives of U.S. pension funds, whom Netanyahu encouraged to stop investing in any company that does business with Iran. One session with the state treasurer of Massachusetts and pension representatives from Rhode Island as well as New Hampshire legislators could lead to concrete steps in the next few months, sources tell TIME. "I'm generally opposed to bringing politics into investing, but former prime minister Netanyahu gave an impassioned plea as to how divestiture could be successful and why it is important, not only to the Middle East but to the entire world," Massachusetts State Treasurer Tim Cahill told TIME. "We're exploring the financial impact of such a move," he said, adding that the $46 billion fund is also exploring investment opportunities in Israel and Jordan, a close American ally.

Netanyahu's session with Cahill, a Democrat, was arranged with help from former Massachusetts governor and Republican presidential candidate Mitt Romney, who himself has recently visited Israel. Netanyahu has also said he plans to meet with governor Arnold Schwarzenegger of California, a state that has huge pension funds, including the influential Public Employees Retirement System, or Calpers, worth some $225 billion.

Netanyahu's efforts are just one part of a still small but growing U.S. finance trend known as "terror-free investing." Modeled in part on the economic boycott of apartheid-era South Africa, "terror-free investing" is designed to isolate countries on the U.S. terrorism list like Iran, Sudan and North Korea by purging U.S. pension funds of the stock of any company that might do business with such regimes. The state of Missouri has gotten its multibillion-dollar Missouri State Employees Retirement System screened to remove what it regards as terror-related investments, with counsel from State Street Global Advisors as well as the Washington, D.C.-based Conflict Securities Advisory Group. The Louisiana sheriffs public pension fund has adopted a similar approach, with advice from T. Rowe Price.