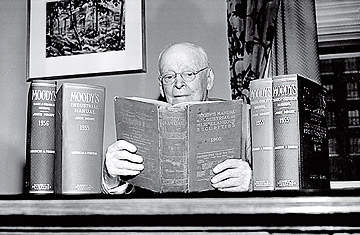

John Moody puts out Analyses of Railroad Investments and for the first time assigns grades to publicly traded securities.

In 1909, John Moody became the first financial analyst to assign letter grades to railroad bonds, giving investors an easier way to evaluate the rail companies' debt. It was the beginning of one of the most powerful forces in modern capitalism. Today a small club of bond-rating agencies, led by Moody's, Standard & Poor's and Fitch, wields enormous power, sending investors scrambling simply by changing the ratings that the firms assign to everything from Ireland's sovereign debt to General Electric's IOUs. They are pilloried for having wildly overestimated the quality of mortgage-related securities.

Poor's Publishing (later Standard & Poor's) started selling...