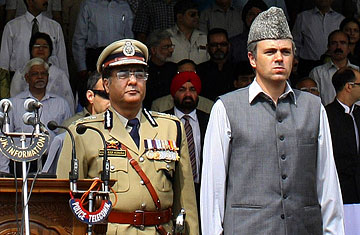

A shoe is hurled toward Jammu and Kashmir state Chief Minister Omar Abdullah, right, during an Independence Day celebration in Srinagar on Aug. 15, 2010

Only a few weeks ago, wherever you went in Europe, you heard the same complaint: Germany's obsession with fiscal austerity and its reluctance to throw a lifeline to ailing euro-zone members was going to pull Europe back into recession.

But the naysayers have been proved wrong. Call it Germany's new economic miracle: official data released by European Union statistics agency Eurostat on Friday, Aug. 13, show that growth in the euro zone is chugging along at its fastest clip since 2006. And at the front of the European train is a German engine charging out of recession. Europe's largest economy accounted for about two-thirds of euro-zone GDP in the second quarter and is growing twice as fast as the rest of the bloc.

Germany's economy, boosted by surging orders for its world-class machines, automobiles and other manufacturing products, expanded 2.2% in the second quarter over the previous quarter, pulling along behind it the rest of the euro zone, which posted growth of 1% in the same period. The German economy is now growing at its fastest rate since unification in 1990. "We shouldn't put Germany and the euro zone in the same boat," says Jörg Krämer, chief economist at Commerzbank AG. "Without Germany, the euro zone would only grow about 0.8% this year, but we expect growth in the euro zone as a whole of 1.5%."

Speaking to Bloomberg, Andreas Scheuerle, an economist at Dekabank in Frankfurt, said that at this rate, Germany is looking a lot like an emerging-market economy on par with countries such as China and India. Scheuerle estimates that Germany's economy grew 9% in the second quarter in annualized terms — after contracting 4.7% last year. Economists are encouraged by the nation's strong performance; in a report following the release of Friday's data, Krämer raised his German growth forecast for the full year from 2.5% to 3.25%.

It would be easy to explain the revival of the German economic motor as the effect of a 10% drop in the value of the euro against the dollar this year, but that's only part of the story. Germany's advances, especially over the past decade, are the product of restructuring, productivity gains and wage restraint to push down costs. At the same time, German companies, especially the midsize companies that make up the "Mittelstand" — the backbone of the German economy — are investing more in R&D than many of their rivals, meaning they often manufacture products that no one else can, giving Germany an edge even when its products are more expensive.

Fifty years ago, Germany's famous "economic miracle" helped it rise from the ashes of World War II. Realizing that the market was too weak to support rapid growth, West Germany focused on manufacturing for export. In 1960, the country's share of global trade was about 8.8%, while the U.S. share had fallen to 16%, down from 20% in 1949; by 1990, a unified Germany had overtaken the U.S. as the leading export nation. As German companies — from electrical-engineering giant Siemens AG to smaller companies like lasermaker Trumpf AG — increasingly targeted global markets, exports as a part of Germany's total output rose sharply. In 1991, manufacturing exports accounted for 22.4% of GDP. By 2008, Germany was exporting $1.4 trillion worth of manufacturing goods, and manufacturing exports comprised a full 41% of GDP.

Now exports are helping pull Germany out of the Great Recession, as strong demand from Asia fills the order books of the nation's companies after a historic drop of 14.2% last year. Once considered the sick man of Europe, Germany has made more gains over the past decade to improve industry competitiveness than any of its major trading partners. In real terms, total compensation per German employee fell 0.5% from 2000 to 2008, according to the Organization for Economic Cooperation and Development (OECD). Among other G-7 countries, only Italy saw a fall in compensation in that same period, while in all of the others, employee compensation rose. The upshot: since 2000, Germany's share of global trade has grown 8.94%, while the U.S. has lost nearly 13%, the U.K. has shed 14%, and France's share has plunged 23%.

Germany's competitiveness is perhaps the most important driver behind the country's furious recovery from the crisis. Friday's data show that as the global economy begins to improve and demand returns, other European countries are not benefiting to the same extent as Germany. The French economy grew an anemic 0.6% in the second quarter, while Spain's economy is limping along with growth of 0.2%. Greece, bailed out by the E.U. and the International Monetary Fund in May, saw its economy contract 1.5%.

But analysts warn that the German locomotive could quickly run out of steam. Right now, Germany's growth relies entirely on exports; domestic demand, both private consumption and public spending, are still too weak to stimulate the broader economy. In its most recent report on Germany, the OECD predicts that consumer spending will fall 1.4% this year. And the push to cut public spending will further slow down economic growth. Soon, exports may not be enough to keep Germany's economy going strong. "The German recovery will weaken as global demand slows and its own fiscal consolidation begins next year," says Jennifer McKeown, an economist at Capital Economics Ltd. in London.

So for now, the German economy is experiencing one of its best years in a long time. But when the German engine cools later this year, the rest of the euro zone could find itself sinking back into recession.