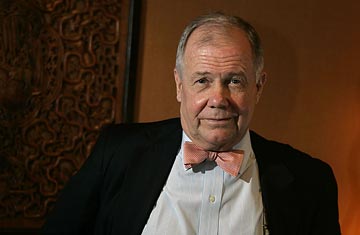

Investor Jim Rogers

Jim Rogers' daughters may not have been born with silver spoons in their mouths, but they've got them now. Not silver spoons, exactly, but silver bullion. "My little girls don't own stocks — they own commodities," he says, "and that's why they'll be able to take care of me in retirement." Rogers, a former hedge-fund manager, author and B-school professor and now bicontinental showman (he lives in Singapore and New York), was slamming stocks and praising precious metals in front of an eager audience of investors who had packed a basement auditorium in midtown Manhattan to hear their favorite teacher.

Rogers is fairly famous among the investing crowd for being a superbull on commodities. His investment convictions spring from an unflappable confidence in his ability to spot emerging secular trends. He looks at the same headlines we all do — that the U.S. government is running gargantuan deficits, that China's huge account surpluses are being smartly invested, that the world economy is experiencing tectonic shifts. But Rogers sees each bit of news as a piece of a bigger puzzle. When he finally can divine what the puzzle says, he bets heavily, writes books about it and gathers a crowd around him. No one knows how heavily he bets, because Rogers is a private investor, but it's safe to assume that it's more than you or I have in our brokerage accounts.

Consider what he did the last time he saw one of these trends coming: in the early '90s, he traveled the world on his motorcycle, then wrote a book, Investment Biker, that helped popularize emerging markets at the beginning of their long bull run.

Rogers sees three big secular trends now, and he's acting on all of them. First, America's role as the dominant economic power is declining, so why own American stocks? (He doesn't.) Second, China is emerging, and even though it may have crises from time to time, it is a good place to invest. (He does.) Third — and this is the biggie — emerging nations including China are greatly increasing the future demand for commodities such as oil. (He's in with both feet.)

"Thirty years ago, 3 billion people were not even participating in the world economy, and now they are trying to live like we do," he notes. That emerging megaforce, says Rogers, will put a supertight squeeze on commodity prices across the board, from beef to bullion. For the unconvinced, he pulls out a chart showing the average daily per capita consumption of oil in the U.S. at 0.677 bbl., vs. India's infinitely smaller consumption (0.021 bbl.) and China's (0.049 bbl.). "Even if the Chinese and Indians just start consuming as much electricity as Koreans now do, the price of oil will take off," he says.

Rogers isn't just an investor; he's an impassioned salesman, part Jimmy Swaggart, part Howard Ruff. There are several commodity exchange-traded funds (ETFs) now trading under the Rogers name, and his very appearance last Thursday, Oct. 8, was to help hawk two new precious-metals ETFs — one for gold and one for silver — being offered by ETF Securities USA, which hired Rogers to speak.

Maybe it's the bow tie, his Alabama drawl or his professorial demeanor, but when Jim Rogers speaks, even those who disagree quietly rethink their positions. People who challenge him are playfully mocked. Responding to one young business type in the crowd who questioned his thesis, Rogers advised him to "head down to Texas A&M and offer to trade in your M.B.A. for one of their agricultural degrees." Become a farmer, he advised the guy: "You'll make out better than you will with your M.B.A." The man tried to respond but was drowned out by laughter.

Own government bonds? Don't tell Jim. "How could anybody in their right mind lend money to the U.S. government at 4% for 30 years?" He draws out the enunciation of "30 years" as if he can't even believe he's saying it, can't believe that anyone could be that stupid.

Rogers believes some eternal truths: that even God-fearing politicians lie about their intentions, and that governments will steal from you. "Think it won't happen here?" he asks. "Just look what they did to GM bondholders."

He also fervently believes in investment cycles as a natural outcome of human behavior. The commodities boom is one such cycle, he says, and it won't last forever. "These commodity bull markets tend to last 18 to 20 years. The current one started 11 years ago," he says. No one knows when a cycle will end, Rogers says, but it's clear from his ebullient tone that he believes the best part of the ride is still ahead. That especially holds true for certain commodities that have not yet had their big run. "I like gold [partly as an inflation hedge], but I'm even more interested in silver, which is still 70% below its all-time high."

Silver. Hmmm. Hardly has that thought sunk in before I'm back to watching Jim prance across the stage, dipping into geopolitics — "whenever in history an established power is being surpassed by a rising power, they clash," he said, referring to a potential U.S.-China faceoff — and giving the audience a peek at what may be his only anxiety, water. Or rather, China's inadequate supply of it. "If they run out of water, all bets are off — it's the one thing you can't do without," he says. Boy, this guy is smart.

But if he's so good at investing, why is he out shilling for someone else's funds?