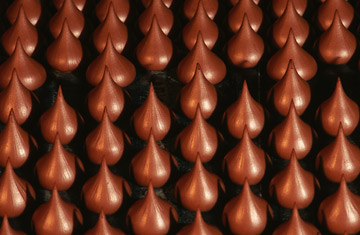

Hershey's famous chocolate Kisses roll out on the factory production line in Hershey, Pa.

Kraft's unsolicited bid to take out candy giant Cadbury PLC in a GBP10.2 billion ($16.7 billion) deal has Wall Street placing bets on whether rival Hershey Co. will jump into the fray.

Cadbury swiftly dismissed Kraft's bid as too low, but speculation is running rampant on Wall Street that Cadbury is now in play and that either Kraft will sweeten its offer or another rival, such as Hershey, will step up. Industry experts speculate that bidding could exceed $21 billion before a merger is clinched.

Hershey, which makes candy under such brands as Hershey, Reese's, Kit Kat, Bliss, Twizzlers and Ice Breakers, has long been touted as an ideal partner for Cadbury. A marriage would combine the Hershey, Pa., company's dominant position in the U.S. candy market with Cadbury's stellar role overseas to create an international powerhouse. The two have been involved in merger talks off and on for more than a decade, with Cadbury being the suitor. However, Hershey has always been the reluctant bride, with the company's Hershey Trust, which controls more than 75% of the company's voting shares, posing the biggest roadblock.

Until now, the trust has steadfastly insisted it prefers to go it alone, even rejecting a $10.2 billion bid made jointly by Cadbury and Nestlé in 2002. It does, however, hold the rights to manufacture and distribute Cadbury's products in the U.S. through a 1988 licensing agreement, notes Kirk Saville, a Hershey spokesman.

Some industry experts now wonder if the Hershey Trust will rethink its stand in light of the Kraft bid. After all, if Kraft ups its ante and succeeds in acquiring Cadbury, it would create a combined company that would rival Mars in size and reduce Hershey to a distant fourth in the confectionary market with only a 4% stake, estimates Stifel Nicolaus analyst Christopher Growe.

"We believe Hershey will be faced with a difficult competitive situation," says Growe, in which the larger entities could use their scale to operate more cheaply than Hershey could. "If there was ever a time for the trust to reconsider its position of maintaining control of the company, this is no doubt it."

"The trust insists on keeping numerical control, which is unheard of today when you have to get bigger and you have to grow," says an observer. "It's a 1930s mentality."

Mort Pierce, chairman of the merger-and-acquisition practice at Dewey & LeBoeuf, who recently handled the Disney-Marvel deal, says the company has a fiduciary responsibility to consider all options.

Also, most analysts think the sector's greatest growth potential in the years ahead will come from outside the U.S., especially in the emerging markets, such as China and India, where Hershey has little exposure. In 2008, U.S. sales accounted for more than 90% of Hershey's sales revenue, according to the company's 10-K filing. And analysts believe the chocolate magnate's most effective way to expand its global reach is by acquiring or merging with a company that already has a big confectionary footprint in those markets.

"It would be very hard to move into these countries without Cadbury or Nestlé or somebody else [who is already there]," says Marcia Mogelonsky, a senior analyst at Mintel International Group, a market-research company.

Hershey could jump-start its growth by making a run for Cadbury, although it would probably be costly. Kraft's current bid, although a 31% premium over Cadbury's closing price on Sept. 4th, the last trading day before the bid was announced, values Cadbury at about 11 times 2009 EBITDA, estimates Growe. This is far below the 19 multiple that Mars paid when it snapped up Wrigley in a $23 billion deal last year. And Cadbury's growth potential, as outlined by the company's CEO Todd Stitzer last year, is bigger than Wrigley's was at the time. Analysts believe a suitor would need to pay at least a 16 multiple, or about $21 billion, to seal a deal with Cadbury.

For Hershey, this price tag would be tough to handle on its own and would most likely require 65% equity financing and $225 million in synergies to make financial sense, says Growe. However, Hershey could potentially team up with Nestlé to bid for Cadbury, with Hershey grabbing Cadbury's chocolate business and Nestlé picking up its chewing gum and candy operations. "They could divide and conquer without giving up control of the company," he says.

Hershey and Nestlé have had discussions but faced an impasse over who would get the gum business, according to someone familiar with the situation. Nestlé wants the gum operations for itself, while Hershey prefers it be shared through a joint venture.

Hershey could also form a partnership with Cadbury, although this would require Hershey's Trust to relinquish control of the company — which Growe thinks is unlikely.

If Hershey doesn't step up, "its growth ability will be dramatically impaired," says an observer, adding that it has "an ability now to put gum and chocolate together in the U.S. and be a real competitior to Mars-Wrigley."

Hershey spokesman Kirk Saville declined to comment, saying Hershey doesn't make statements on merger-and-acquisition issues.

While a merger or partnership could enhance Hershey's global growth prospects, it's not critical for the company's survival. Hershey still leads chocolate sales in the U.S., with a 40% market share.

"Hershey isn't going to disappear. The U.S. might be a slow-growth market, but it's the biggest market in the world," says Mogelonsky. "It might be hard for Hershey to compete globally, but I think Hershey will still remain strong in the U.S."

Douglas Christopher, an analyst at Crowell, Weedon & Co., even sees advantages in remaining a smaller entity. "The larger the company, the less nimble you are," he says. "It has a great brand and many great products. We think Hershey is well positioned to continue to operate independently."