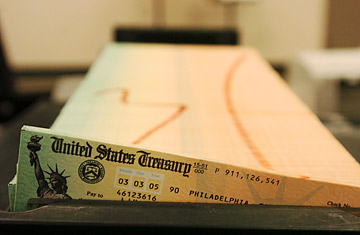

Trays of printed social security checks wait to be mailed from the U.S. Treasury's Financial Management services facility in Philadelphia.

Every major newspaper and online news service carried that same headline, perhaps all written by the same copy desk: "Medicare And Social Security Face Insolvency." Cynics said that the announcement by the Social Security and Medicare Boards of Trustees will be used as a powerful argument to raise taxes to replenish the funds. Skeptics said that the data is based on forecasts which could change radically over the next several years. Anyone who doubts the projections will say that they are the work of actuaries who practice an art as dark as voodoo.

The 2009 edition of the "Status of the Social Security and Medicare Programs" is a swamp of data which is only useful it if it turns out to be correct. There is no evidence that most of the assumptions are accurate any more than there is proof that the new federal budget and its forecast deficits are accurate. The White House recently changed its deficit projection for the next fiscal year by $89 billion. (See TIME's A-Z Health Guide.)

The report from the Trustees blames the economy for the fact that the Medicare's Hospital Insurance Trust Fund will have exhausted its reserves in 2017 and that the Social Security trust fund will be in the same position in 2037. The report for the two funds makes an attempt to project income and expenses for the funds from 2009 to 2018. While it is improbable that the numbers are correct, a forecast that makes a prediction for a period of a decade could be, if well argued, plausible. But, to accept the results of the report, anyone looking at it would have to believe that the trustees have the capacity to have an accurate picture of the economy seventy-five years from now. One of the critical assumptions of the report is that "In 2083, the combined cost of the programs would represent 17.2 percent of GDP."

Putting the public on notice that it faces a sharp diminution of critical social programs based on data which will need to be correct 10, 40, and 75 years from now is an example of why citizens and taxpayers often ask how the government bases financial decisions on opinions offered by people who spend years in windowless rooms. In those rooms, they evaluate data and change it as they get new pieces of financial information, some of which requires subjective interpretation. Economists and actuaries do not like being told that their forecasts are likely to be less accurate than those of veterinarian scientists forecasting the gestation terms of mules.

Taxpayers resent being told that any human can know how many angels can stand on the head of a pin. They are alarmed that this information could then be used to deprive them of a social safety net in the future or that they will be required to pay a greater portion of their wages into the federal system. The subject that has not been raised with the announcement of the new projection about the Social Security and Medicare funds is what government expenses might be eliminated to save benefits from the two programs decades from now. People would like to know why the income side of the ledger is at the center of the conversation and the issue of government expenses is neglected. The federal government admits that payments from Medicare and Social Security could disappear in the future, but immediately offers a solution that requires its citizens to increase payments into the system.

The Social Security and Medicate data comes at a sensitive time. People who fear that they will soon be out of work and have friends, relatives, and neighbors who are out of work are being told that the only way that the recession will end is if the government buys its way out of economic trouble. With unemployment rising, the math that taxpayers face is that fewer people will have to pay more to keep the nation from a depression and worsening unemployment. In addition, they are being told that the future of American social services is also in their hands.

The time will come, and probably come soon, when no matter what statistics the government gives to voters, they will insist that the money being spent on national monument repairs, NASA, hog subsides, and a new presidential helicopter go away. The government says that all of this money has to be spent, but the pack mule that the taxpayer has become can only carry so much weight.

— Douglas A. McIntyre

For constant business updates, go to 24/7wallst.com.