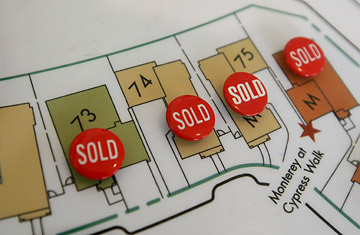

Homes are designated as sold on a map of a new housing development in its sales office in South San Francisco, California.

Warren Buffett said that the real estate business his company Berkshire Hathaway owns is seeing a small improvement in housing demand. The National Association of Realtors seemed to confirm his observations when it announced that the index for pending home sales went up in March. This data helped send the stock market higher as it stays true to form by rising on the most modest news.

Except for low home prices and very low mortgage rates, all of the elements for a recover in housing are missing. Those two things should be enough, but balanced against them are shrinking access to credit, an inability of Americans to get higher wages, and crippling unemployment. (See pictures of Cleveland struggling with unemployment.)

The April unemployment figures will be out later this week. Six hundred thousand people lost jobs last month, according to most estimates. Two and a half million people have lost work since the beginning of the year. A housing recovery cannot occur in the presence of the massive collapse in unemployment. The devastation of the potential home buying base is too great. Many of the people who lose jobs will also lose their houses and that increases the inventory of unsold homes.

Consumers have lost access to credit. The fact that mortgage rates have dropped does not even begin to offset that. Qualifying for a mortgage is harder than ever. Banks have reason to be cautious. One of the large credit bureaus just released a report that says 4.7% of payments for bank-issued credit cards were late sixty days or more in March, an increase of 38% over the same month last year. According to Reuters, "In March, lenders closed 20 million card accounts, sending the total down by 58 million since the peak in July 2008 to 380 million." Banks will not be lending to consumers as long as there are no solid and sustained signs of an economic recovery. They cannot afford the risk after all of the write-offs they have already taken. (See pictures of TIME's Wall Street covers.)

The single biggest enemy to a housing recovery may be the fact that there is no increase in real wages. The failing economy has ruined any chance that the average worker will make more this year than he did last. Many people will probably make less this year than they did in 2008, although the government figures are not precise enough to show that. Anecdotally it is almost certainly true. Earning a higher wage with unemployment more than 10% has to be nearly impossible in some of the largest states including Florida, Michigan, and California.

The recession has gone on so long and has been so crippling that the eyes of the wishful begin to play tricks. A small piece of economic information, like one month of very modestly improved housing numbers or one week of a slight decrease in jobless claims, sets off a chain reaction. If one set of numbers is OK, the next set will be better. Real estate prices will stop falling everywhere, if they stop falling in hard hit Nevada. (See pictures of Las Vegas.)

Home prices will not get better until the elements that made housing prices perform so well for almost ten years return. Those elements may not come back with the force that they had in 2003, 2004, and 2005, but they must make a modest recovery for housing to recover. People have to be able to believe that they have some meager job security. A bank has to tell them that it wants their business. And, they have to feel that they can, if only rarely, get a raise.

— Douglas A. McIntyre

Read "Four Steps to Ending the Foreclosure Crisis."

For constant business updates, go to 24/7wallst.com.