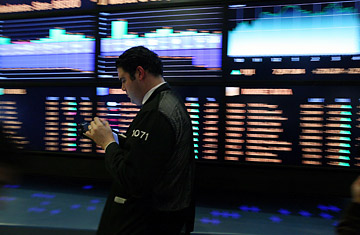

A trader works on the floor of the New York Stock Exchange

There is a saying on Wall Street that even dead cats bounce. Financial stocks appear to be purring again.

Banks shares leapt 53% since early March. That's more than double the 21% jump in the overall market since stocks hit a low on March 9. Investors are pilling into financial firms in that hopes that changes in accounting rules, optimism from bank CEOs and government fixes spell the bottom for these stocks. (Read "Unemployment Rise Shows Recession Far From Over")

But a number of risks remain for the nation's largest banks, any one of which could derail the recent rally. Not only will banks' earnings probably be down in the first quarter, Treasury Secretary Timothy Geithner's plan to rid the banks of their troubled loans suggests there could be billions more in losses as banks offload these loans in the quarters ahead. What's more, a number of banks have yet to deal with a requirement to recapitalize their large trove of off-balance sheet assets, which will put further strain on banks already strapped for cash.

Add to that the tug of recession. "Our core view is that banks' [stocks] will not bottom until nonperforming [loan] growth decelerates," opined Goldman Sachs analyst Richard Ramsden in a report to clients on Friday. "All of the data points we track in the first quarter point to an acceleration." Banks are expected to report their results for the first few months of the year in the next two weeks. And despite positive statements from bank CEOs in recent weeks, earnings at nearly all of the nation's largest banks will likely have fallen in the first quarter versus one year ago. The one exception is Citigroup, which will probably report a loss, though less than a year ago. Citigroup's red ink this time around could washout at $1.8 billion. (Read "Citigroup's Mergers Business Is Still Thriving.")

That's hardly the last of the red ink. In mid-March, the Treasury Department unveiled a plan to help banks sell the mortgages and other soured loans that are sitting on their books. The plan may save banks money in the long run, but it could be very costly over the next year or so. The reason is simply that many banks have only minimally written down the value of these troubled loans, and once they hit the marketplace they could be valued much lower. Geithner's plan offers cheap loans to investors to try to entice them to pay handsomely for these loans, but investors are unlikely to pay full price or even close to it. So in order to sell the loans banks will have to recognize losses that could run as high as $200 billion for the sector in general. "The gap between bank marks on these distressed [loans] and their economic value appears to be too wide to be bridged," says Morgan Stanley analyst Richard Berner of the government program.

The biggest bad surprise for investors in bank stocks, though, could come from pools of so-called shadow assets that have been following around these banks for years. In the earlier part of this decade, banks set up a number of financing arrangements called special investment vehicles or variable interest entities. These arrangements each had different functions, but they were generally known as special purpose entities and they had the effect of keeping certain loans off bank ledgers.

A recent change in accounting rules means that banks are going to have to bring those loans back on their books by the end of this year. The biggest fear is that banks will start recording losses from these loans that investors weren't expecting. There's a second problem related to shadow assets: Regulators say that banks must hold capital equal to at least 5% of their assets to be considered healthy. Citigroup, to take one example, has about $850 billion in special purpose entities. That means to reincorporate those assets by the end of this year, Citigroup will have to come up with $42 billion in new capital — money that will have to come from Uncle Sam, which could further dilute the value of Citi's shares.

"The change in the way banks have to account for these special purpose entities will mean great danger for their capital ratios," says corporate accounting expert Robert Willens.

Stock prices can rise sharply on the prospect on improving profits. For many banks, the more likely prospect in the months ahead is for continuing problems.

Read first-hand accounts of the Great Depression from the people who lived through it