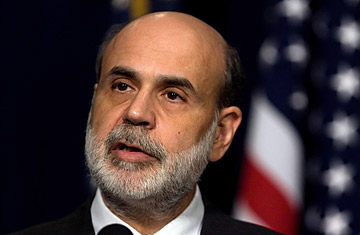

Federal Reserve Chairman Ben Bernanke

The Federal Reserve announced Wednesday afternoon that it was lowering its target short-term interest rate to 1%. Big deal. Almost everybody was already expecting the half-point rate cut that the Fed delivered, and the actual federal-funds rate (as opposed to the target rate) has mostly been below 1% for the past three weeks anyway. The stock market's reaction? A yawn, as the Dow closed down 74 points.

So what news was there in today's announcement? Well, nobody dissented, for one thing. The five interest-rate cuts in the first half of this year all came in the face of no votes, as a hawkish minority on the Federal Open Market Committee (FOMC) worried that Fed Chairman Ben Bernanke risked setting off an inflationary spiral. Now everyone at the Fed seems to have come around to Bernanke's Great Depression–influenced view that it's a deflationary spiral that we really need to be worried about.

That brings us to the other big news in the announcement. The FOMC left the door wide open for even more rate cuts, which would bring us into uncharted territory. The federal-funds target rate previously bottomed out at 1% from June 2003 to June 2004. The actual federal-funds rate did drop below 1% a few times in the 1950s, but that was another era — an era when the Fed didn't announce interest-rate targets, banks completely dominated the financial system and the U.S. completely dominated the global economy, and there was no such thing as a money-market fund.

If the federal-funds target rate were cut to 0.75%, many money-market funds that invest exclusively in government debt would struggle to cover their costs and still pay a positive return to investors. The Fed has a new facility in the works, the Money Market Investor Funding Facility, that's intended to ease these pressures. Once that's up and running, don't be surprised if short-term interest rates keep dropping, even to 0% — as was the case in Japan from 1999 to 2006. The Fed would literally be giving money away.

And that wouldn't be the end of it. In November 2002, during his first stint on the Fed — as a mere member of the board, not the chairman — Bernanke gave a now somewhat infamous speech about what central banks could do to fend off deflation even after short-term interest rates hit zero. The Fed could target longer-term interest rates, he argued. It could buy private securities, not just Treasuries. It could, figuratively speaking, drop money out of helicopters.

We've already seen some of this throwing-the-kitchen-sink-at-the-problem approach over the past year. Expect much more in the coming months. Bernanke is committed to avoiding serious deflation, because he's convinced that serious deflation makes an economic downturn much worse by making it much harder for debtors to pay back loans. That's probably the right stance right now. When banks and consumers are both trying to cut back on their debts on a mass scale, deflation really is the big threat.

But throwing money at the economy's problems is not without risk, and it will be interesting to see whether the Fed is able to react quickly enough in the other direction when the economy finally takes a turn for the better, and avert the inflationary spiral that Bernanke's critics have been warning about all along.