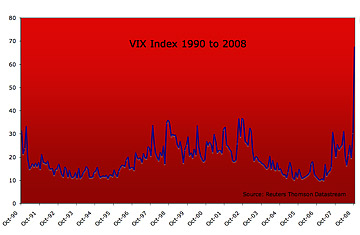

VIX index goes off the charts in 2008.

From stocks to house prices, profits to banks, right now, just about everything seems to be falling. Amid the carnage, though, there's at least one measure you can't keep down: fear. Wall Street's favorite measure of market volatility and investor jitters, the Chicago Board Options Exchange Volatility Index — VIX for short — briefly topped 80 points for the first time Thursday, as U.S. stocks slipped on a pile of poor economic news. The VIX, dubbed the "fear gauge", eventually closed at a touch under 68, three times the average over its 18-year history. Prior to this past week, the index hadn't even scaled the 50 mark.

As a measure of how volatile investors reckon markets will be in the short term, the sharp sell-offs seen in recent months have sent the VIX to its eye-popping highs. The index is calculated from the price of options — a deal to buy or sell an asset at a fixed price and time — linked to the S&P 500. As the value of that index plummets — the leading benchmark of U.S. stocks has lost about a third of its value this year — investors are scrambling to pick up options in order to hedge against those losses. That, in turn, drives up option prices, as well as the VIX. In other words, the higher fear levels get, the more the volatility index rises. (The reverse is true, too: when U.S. stocks rallied sharply Oct. 13 in response to plans announced by the U.S. Treasury to buy stakes in big banks, the VIX slid 21%.)

But it's more than just a measure. Where there's volatility, there's money to be made. Investors have been able to trade options on the VIX — essentially, bets against the index's own movements — since the Chicago Board introduced them in 2006. What's more, niche hedge funds set up to wager on rising volatility — New York-based AM Investment Partners, for one — have outperformed the markets as well as conventional funds in recent weeks. If that seems a bit rich, it might be time to add some volatility to your portfolio.