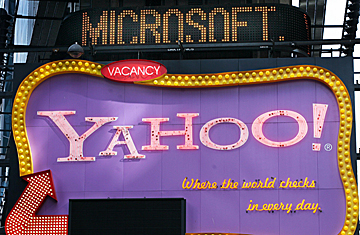

Yahoo never really wanted to be bought by Microsoft. Although Jerry Yang repeatedly said that he would consider Microsoft's bid, he showed little interest in actually making a deal, instead focusing his energies on finding alternative suitors. Now, Yang appears to have gotten his way: Less than a month after threatening a hostile takeover if Yahoo declined its initial $44.6 billion offer, Microsoft CEO Steve Ballmer formally withdrew his company's offer. In a letter to Yang on Saturday, Ballmer expressed dismay at the second-ranked search company's unwillingness to come into the fold: "Our discussions with you have led us to conclude that ... you would take steps that would make Yahoo undesirable," wrote Ballmer. Yang responded with a press release, expressing relief at having ended interest from Redmond: "With the distraction of Microsoft's unsolicited proposal now behind us, we will be able to focus all of our energies on executing the most important transition in our history."

Although Microsoft had threatened to walk in recent weeks, many suspected that was merely a negotiating tactic. "It's an amazing turn of events," says internet analyst Greg Sterling of Search Engine Land. "Microsoft had expressed such confidence in the deal, and everyone believed it was going to happen." Just a week ago, Citigroup's Mark Mahaney, a leading Wall Street analyst, rated a Microsoft takeover of Yahoo as a 90% probability. "Would Microsoft really walk away after stalking Yahoo for two years? Microsoft has $1 billion in operating losses to show for its organic internet efforts over the last year," Mahaney wrote in a April 25 report.

The disdain may have been mutual: Despite Microsoft's pursuit, it never seemed genuinely interested in Yahoo as a company, either. In a town hall meeting with Microsoft employees last week, Ballmer said, "Yahoo's not a strategy. It's a part of a strategy." He also indicated that his main interest in Yahoo was for its massive reach rather than for its technology — Yahoo may be struggling to grow its earnings, but it still has more visitors than any other property on the Internet, including Google.

So, what comes next?

Yahoo stock will tank on Monday morning even faster than it soared late Friday afternoon, amid rumors of an imminent deal. Ballmer confirmed in his Saturday letter that Microsoft had raised its bid to $33 a share, but Yahoo was reportedly holding out for up to $37 a share. Now, Yahoo's best bet for raising revenue fast lies in expanding its recent, successful trial of Google's adSense internet advertising technology, which could bring in as much as $1 billion a year. But while that would mollify investors in the short term, it's a risky strategy. Any kind of partnership between Yahoo and Google, which together control more than 80% of the online ad market, is certain to raise antitrust concerns.

Microsoft has already started lobbying Capitol Hill against such a deal, and Ballmer wrote in his Saturday letter that this "would raise a host of regulatory and legal problems that no acquirer, including Microsoft, would want to inherit." What's more, outsourcing to Google devalues Yahoo's own advertising platform, called Panama, which could hurt Yahoo's earnings over the long haul.

Microsoft could always come back to Yahoo in a couple months, and seek a deal at an even lower price. But for now, its challenge may be damage control. After all, failing in its best efforts to acquire Yahoo has also left Microsoft looking a lot less scary — and a lot less savvy — than in the days when it was the undisputed titan of the tech world.