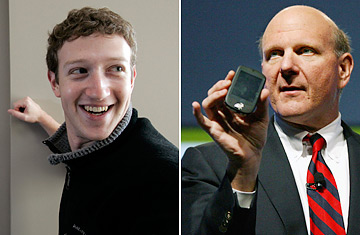

(l. to r.): Facebook's creator Mark Zuckerberg, Microsoft CEO Steve Ballmer

At first blush, it may seem like Microsoft got the short end of the deal when it paid $240 million on Wednesday for a puny 1.6% stake in the social-networking site Facebook. While Facebook is probably the most talked about destination on the Web today, the company will be lucky to clear $30 million in profit (on an estimated $140 million in revenues) this year. So what exactly was Microsoft buying, other than a lot of hope and, quite possibly, a lot of hype?

With $23 billion in cash reserves, the Redmond, Wash.–based software giant can afford to part with a little cash — even if it never earns a penny of it back. And Facebook could use the money — to hire more employees and build out the site, whose traffic is currently growing at over 100% per year, according to comScore Media Metrix, which tracks internet-user demographics. But what Microsoft chief Steve Ballmer and company desperately need these days is cachet in the burgeoning internet economy. And that is exactly what their investment just bought them.

"Microsoft has not had a lot of success with their online plays," notes Shahid Khan, a business strategy consultant at IBB Consulting in Princeton, N.J. Their search engine, Windows Live, is a distant third to Google and Yahoo, in both ad revenue and users. They've lost out to Google on key strategic deals to buy both YouTube and online ad company DoubleClick. And while sales of the new operating system, Windows Vista, have been brisk, reviews have been decidedly mixed.

All that glum news has translated into low morale for a company that was once an undisputed titan of the consumer software business. "Microsoft was this monopoly, but now there has been this humbling. They have been cast as the underdog," says Greg Sterling, an Internet analyst at Sterling Market Intelligence.

Microsoft's partnership with Facebook, which also buys it the rights to broker all international ads, puts the company back in a game that it was struggling to keep up with. By partnering with Facebook, it has also kept key competitors at bay. "The investment Microsoft made was in keeping Google out," says analyst Rob Enderle. Not only will Microsoft garner more revenues by serving up ads for Facebook (the exact revenue split has not been disclosed, but is probably about 20% going to Microsoft) but it also has a great shot at getting its search engine built into Facebook.

And while Facebook's shiny new $15 billion valuation (up from $10 billion just a month ago) may seem out of this world, it pays to keep in mind that it's still just "Monopoly money," notes Khan. With hardly any profits to date, the company's actual valuation is all just speculation at the moment. That should become much clearer, once Facebook goes public sometime in the next year or so. One thing's for sure, however: the dotcom bubble just got bigger than ever. Get ready for another wild ride.